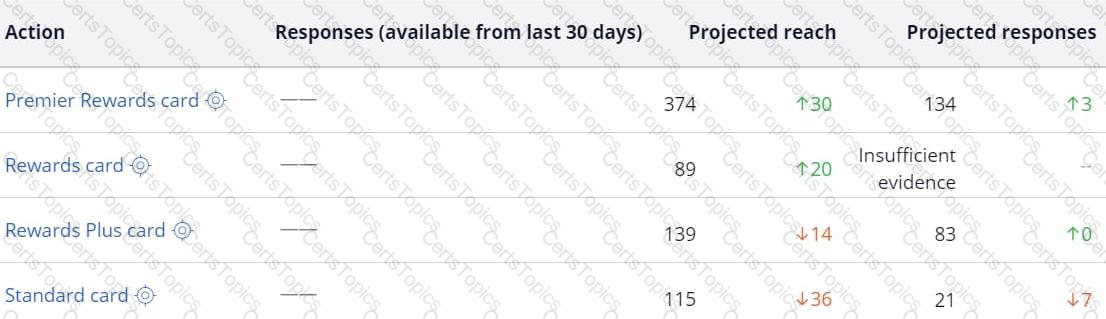

U + Bank, a retail bank, has applied business weight to their credit card offers to manually nudge the offers. The bank analyzes the effect of the change in Scenario Planner. The following image shows the projected reach and responses of the cards in the comparison mode. How many customers are likely to accept the Standard card?

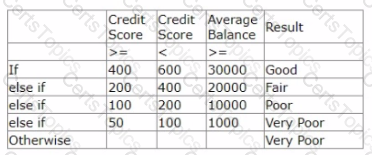

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

In addition to the credit risk requirement, U+ Bank wants to offer credit cards to customers whose age is greater than 25.

As a best practice, which part of Customer Decision Hub do you access to ensure that credit cards are offered only to customers with age greater than 25?

A bank wants to leverage Pega Customer Decision Hub’s Next-Best-Action capability to promote new offers to each customer on their website. Which artifact do you need to configure to manage the communication between the Customer Decision Hub and external channels?

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach.

The company is introducing a new data plan.

To offer the new data plan, what must the mobile company focus on when implementing the Next-Best-Action paradigm?