Pegasystems Related Exams

PEGAPCDC87V1 Exam

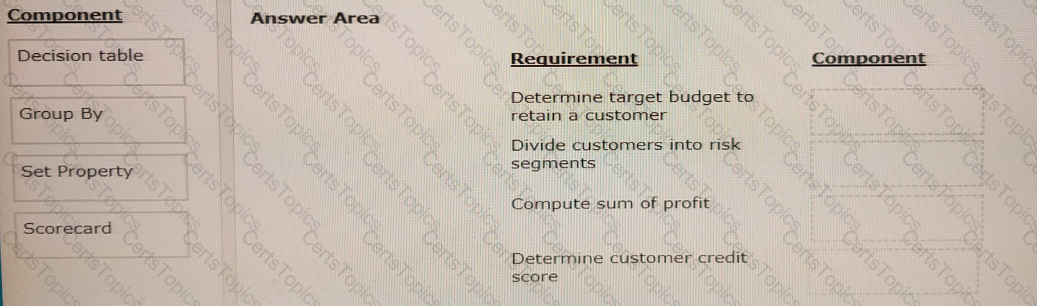

You are a strategy designer on a next-best-action project and are responsible for designing and implementing decision strategies.

Select each component on the left and drag it to the correct requirement on the right.

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

For a limited time period, a bank wants to avoid sending promotional emails related to credit card offers to a customer if they have already received one. Which rule do you need to define to implement this business requirement?