Reference module: Testing engagement policy conditions using audience simulation

U+ Bank, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when the customers log in to the web self-service portal. The bank now plans to amend its engagement policy conditions. As a Decisioning Consultant, which simulation do you run to check if the conditions are too broad or narrow for your requirements?

Reference module: Analyzing the effect of business changes using Pega Scenario Planner.

U+ Bank, a retail bank, completed an implementation to present Credit Card offers to customers on their self-service portals. You want to estimate the business value that the subsequent next-best-action run creates using the selected configuration. Which simulation do you run to get the required information?

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

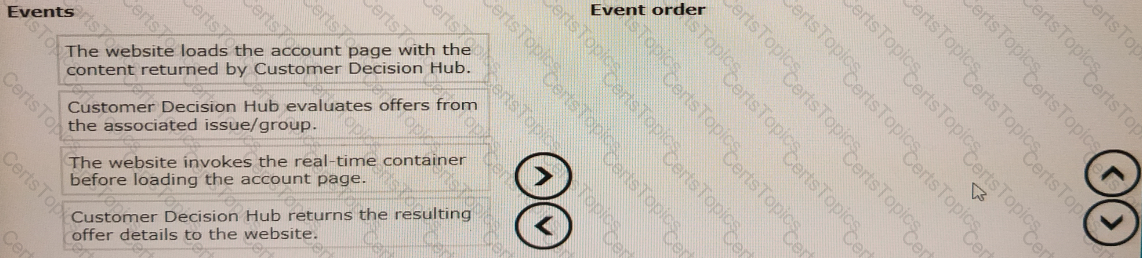

Place the events in the sequential order.

U+ Bank’s marketing department currently promotes various credit card offers by sending emails to qualified customers. Now the bank wants to limit the number of emails sent to their customers irrespective of past outcomes with a particular offer and customer. Which of the following options allows you to implement this business requirement?