Reference module: Analyzing customer distribution using Pega Value Finder.

Myco, a telco, is working on implementing a project in which post-paid offers are presented to qualified customers. In the build stage of the ideation, the business wants to look for new opportunities to improve marketing. As a Decisioning Consultant, which simulation do you run to meet the requirement?

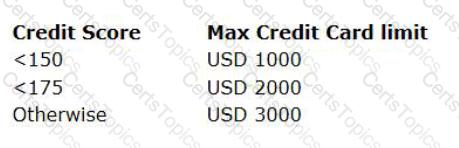

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from “<175” to “<200”.

As a Strategy Designer, how do you implement this change?

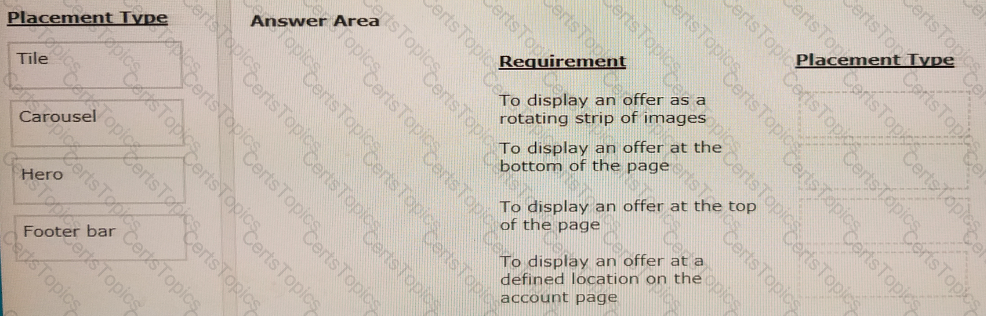

U+ Bank has decided to use the Pega Customer Decision Hub™ to recommend more relevant banner ads to its customers when they visit the personal portal.

Select each placement type on the left and drag it to the correct requirement on the right.

U+ Bank, a retail bank, wants to begin promoting credit card offers via email to qualified customers. The business would like to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?