An employee hired on July 1, 2021, terminates employment on September 30, 2022. What is the earliest date the employer may dispose of the Form I-9?

An employee receives a total of $200.10 in cash tips in July. Determine the latest date the employee MUST report tip income to the employer.

All of the following activities are examples of an internal control EXCEPT:

The DOL can issue fines for all the following violations EXCEPT:

To identify an out-of-balance general ledger account, all of the following documents should be used EXCEPT:

The types of accounts used by businesses to classify transactions are:

All of the following elements are part of the control process EXCEPT:

Which of the following documents listed on Form I-9 can be used to establish both an employee's identity and employment eligibility?

A mechanism which facilitates local tax withholding for an employee who is working abroad, but remains on the home country’s payroll system and is paid under a tax equalization plan, is called a(n):

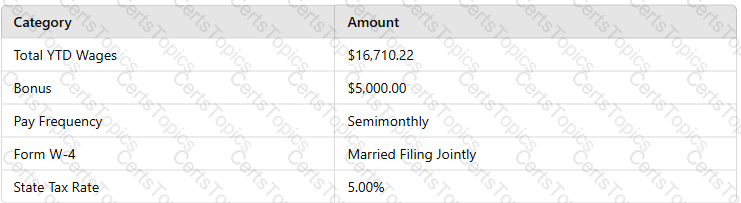

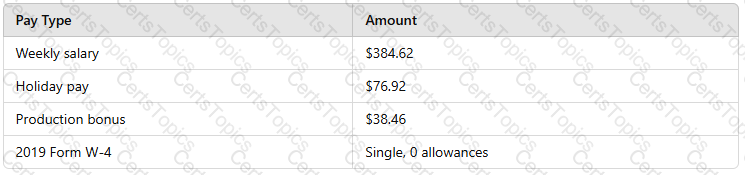

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4. Calculate the net pay based on the following information:

Even if a worker meets the definition of an employee, an employer can still treat the worker as an independent contractor if the worker passes the:

Which of the following circumstances would cause a breach of confidentiality?

Which of the following account types has a normal debit balance?

Which of the following general ledger accounts should normally maintain a credit balance?

Failure to create a payroll ACH file is a violation of which customer service principle?

Based on the following information, using the percentage method, calculate the employee's net pay:

Which of the following wage attachments has the highest priority for withholding?

Payroll standard operating procedures should be updated no less frequently than:

All of the following statements are correct regarding independent contractors EXCEPT that they:

All of the following employee information is required when reporting unclaimed wages EXCEPT:

As of December 31, 2024, what is the MAXIMUM amount, if any, a 49-year-old employee can contribute to a 401(k) plan?

Which of the following simulations would NOT be performed when testing a disaster recovery plan?

Under the FLSA, failure to pay overtime to employees may result in all of the following consequences EXCEPT:

Which of the following criteria is NOT used to determine if the worker is a nonresident for U.S. income tax purposes?

Under the FMLA, employers MUST maintain related leave records for how many years?

Which of the following forms of identification CANNOT be used in Section 2 of Form I-9?

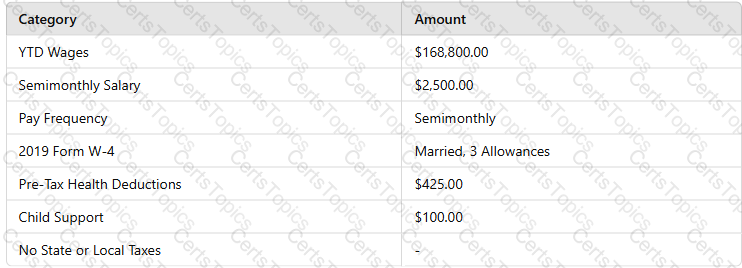

Using the wage bracket method, calculate the employee’s net pay. The employee’s W-4 was completed in 2019 or earlier.

The process used to verify and validate payroll system edits or warnings is called:

Which of the following awards are included in an employee's taxable income?

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

A willful violation of child labor laws, that does NOT involve serious harm or death, can result in a fine of up to:

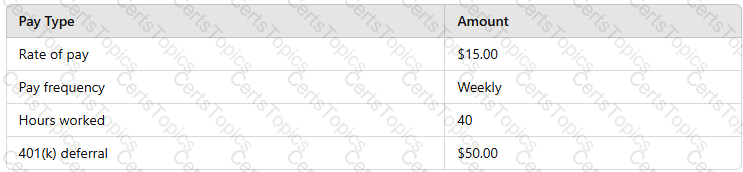

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

Employee privacy rights are NOT governed by:

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information:

The due date for filing Form 941 is the:

The FLSA requires employers to retain employee work time schedules for at least:

A state's minimum wage is $0.60 higher than the federal minimum wage. Under the FLSA, for an employee age 20, what is the MINIMUM hourly rate an employer can pay the employee?

IRS regulations require employers to take all of the following actions for taxable noncash awards EXCEPT:

Workers’ compensation payments are excluded from gross income and employment taxes EXCEPT when the amounts received:

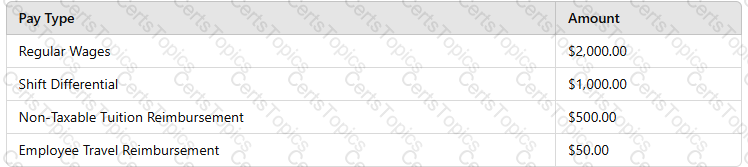

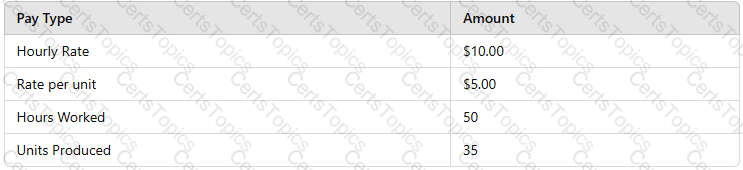

Based on the following information, calculate the employee's gross wages for the workweek under the FLSA.

Which of the following considerations is NOT needed when implementing ashared services environment?

When a payer receives a “B” Notice, it must send a copy of the notification to the payee within:

When providing wage data for a workers’ compensation audit, which of the following wage types would be included as compensation?