APA FPC-Remote Exam With Confidence Using Practice Dumps

FPC-Remote: APA Certification Exam 2025 Study Guide Pdf and Test Engine

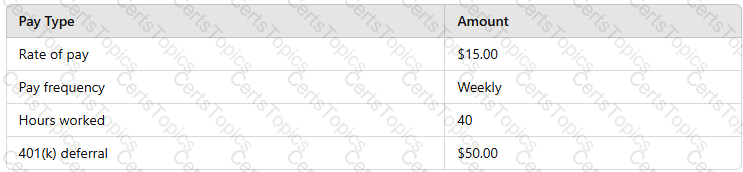

Are you worried about passing the APA FPC-Remote (Fundamental Payroll Certification) exam? Download the most recent APA FPC-Remote braindumps with answers that are 100% real. After downloading the APA FPC-Remote exam dumps training , you can receive 99 days of free updates, making this website one of the best options to save additional money. In order to help you prepare for the APA FPC-Remote exam questions and verified answers by IT certified experts, CertsTopics has put together a complete collection of dumps questions and answers. To help you prepare and pass the APA FPC-Remote exam on your first attempt, we have compiled actual exam questions and their answers.

Our (Fundamental Payroll Certification) Study Materials are designed to meet the needs of thousands of candidates globally. A free sample of the CompTIA FPC-Remote test is available at CertsTopics. Before purchasing it, you can also see the APA FPC-Remote practice exam demo.