Which of the following awards are included in an employee's taxable income?

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

A willful violation of child labor laws, that does NOT involve serious harm or death, can result in a fine of up to:

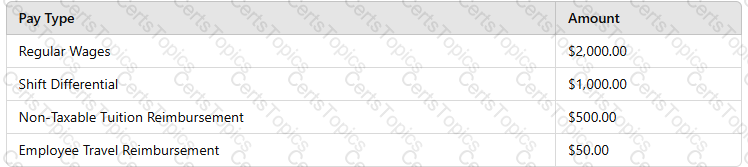

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.