A mechanism which facilitates local tax withholding for an employee who is working abroad, but remains on the home country’s payroll system and is paid under a tax equalization plan, is called a(n):

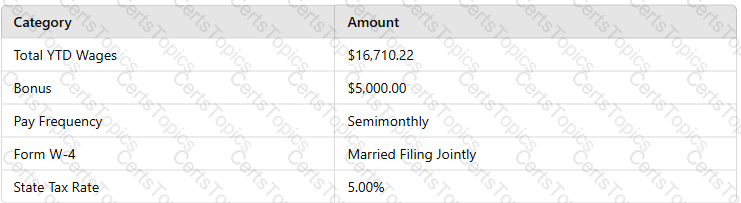

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4. Calculate the net pay based on the following information:

Even if a worker meets the definition of an employee, an employer can still treat the worker as an independent contractor if the worker passes the:

Which of the following circumstances would cause a breach of confidentiality?