Which of the following account types has a normal debit balance?

Which of the following general ledger accounts should normally maintain a credit balance?

Failure to create a payroll ACH file is a violation of which customer service principle?

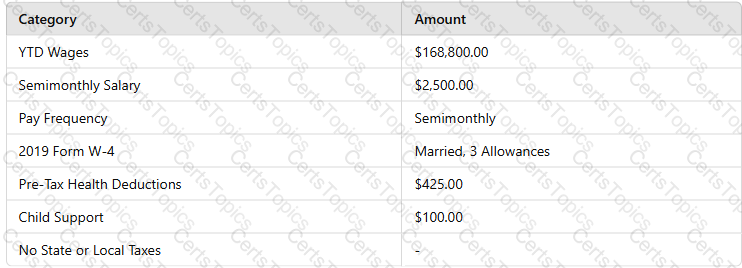

Based on the following information, using the percentage method, calculate the employee's net pay: