A state's minimum wage is $0.60 higher than the federal minimum wage. Under the FLSA, for an employee age 20, what is the MINIMUM hourly rate an employer can pay the employee?

IRS regulations require employers to take all of the following actions for taxable noncash awards EXCEPT:

Workers’ compensation payments are excluded from gross income and employment taxes EXCEPT when the amounts received:

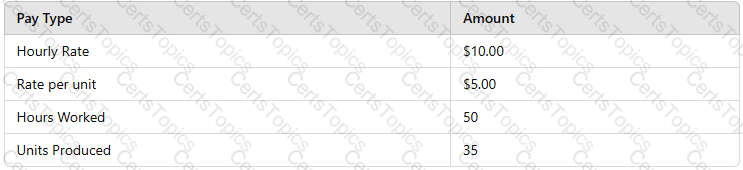

Based on the following information, calculate the employee's gross wages for the workweek under the FLSA.