CT Check Cashing routinely cashes payroll checks from JD Software. Someone presents a fraudulent check from JD Software to CT Check Cashing. The fraudulent item looks virtually identical to JD Software's regular payroll checks. CT Check Cashing pays the person cashing the check the amount for which it is issued. CT Check Cashing later discovers that the check was fraudulent and wants JD Software to reimburse them for the amount of the check. Which of the following statements is correct?

Company ABC experienced a loss in the past when an employee in the treasury department was able to transfer $1.5 million to a personal account offshore. The company is working with a security agent to prevent this from happening in the future. ABC also accepts a large number of checks as payment. The agent has suggested upgrades to ABC’s payment process. What step should be taken to help mitigate this type of risk in the future?

Racklyn Paint Company, a new paint and construction company, has vendor payables of $2 million due periodically over the next 3 months; payroll payable to its crews of $500K each month; a mortgage of $4.4 million with a fixed rate of 6.0%; and an equipment loan of $5 million with a bank at a 30-day LIBOR plus 150 bp payment of $100K due monthly. Racklyn receives their first contract valued at $12 million with half of the contract value due at the time of contract and final payment upon completion. Racklyn expects the job to last 6 months. Which option would be the BEST use of Racklyn Paint Company’s cash?

XYZ Company has decided to purchase a close competitor. This acquisition would make XYZ Company the 4th largest in its industry allowing it better purchasing power and greater distribution channels. After completing the M&A analysis, it is determined that the combined companies would produce a 40% increase in revenue, reduce manufacturing costs by 30%, but would increase current liabilities by 27%. Which of the following would keep the acquisition from happening?

Company XYZ is a high technology company. It is planning on acquiring another company in the high technology sector. Company XYZ does not have enough cash to acquire the company and is planning on financing the acquisition through a bond offering. Which of the following measures is company XYZ MOST LIKELY to use in its analysis of operating profits considering it is a high debt transaction?

The Treasurer of a company would like to establish an investment policy for the organization. One objective that should be included in the investment policy that would BEST allow the organization to limit its exposure to a particular market sector would be to:

The regional offices of ABC Company implemented a system that would allow the employees to pass information between regions in a secure fashion. This system requires that all offices have the same key in order to read messages sent electronically. Which e-commence security type is MOST LIKELY being used?

A customer buys a laptop for $850 and a CD for $13. Only items with sale price of $15 and greater are subject to value added tax (VAT). Assuming VAT of 8.5%, how much tax does the customer incur at the point of sale?

The Treasurer at Worldwide Industries is concerned that its retail lockbox provider, Bank A, is not PCI DSS-compliant. Bank A processes 500,000 checks per month for Worldwide Industries. Worldwide Industries uses a third-party provider, Pay Point, for their credit card payments and funds are wired daily to Worldwide’s depository account at Bank A. What should the Treasurer do?

A cash manager at a U.S. retailer forecasts a positive collected cash position for the end of the current day. The company has an overdraft facility at 10%, a separate investment account earning 8% before taxes, an earnings credit rate of 8% and an outstanding single payment note at 9.5% maturing in 1 week. This month’s bank service fees are expected to exceed the earnings credit. Which of the following options would be the MOST economically positive for the company?

A portfolio manager purchases a floating rate mortgage backed security that would currently provide a 4% yield to the company. Since mortgage rates have been fluctuating significantly over the past month, the manager is thinking about entering into an interest rate swap to hedge against the rate movements. Although the manager would remove most of the price sensitivity of the asset by executing the swap, it would also lower the total yield on the investment due to swap costs. What objective in the company investment policy is guiding the portfolio manager’s decision?

The Treasurer for XYZ Manufacturing, Inc. recently exchanged a portion of its euro holdings into U.S. dollars to purchase gas futures contracts. This was done in anticipation of an assumed rise in gas prices due to the continued weakening of the U.S. dollar. Which of the following types of risk is being mitigated?

Bank A is to pay Bank B $6,000,000 for 10 transactions that occurred throughout the day. Bank B is to pay Bank C $8,000,000 for 13 transactions that occurred throughout the day. Bank B is to pay Bank A $5,000,000 for 17 transactions that occurred throughout the same day. These banks operate using a gross settlement system. How many transactions will occur between these banks to settle the payments?

West Coast Retail Shop has experienced reduced cash availability in its bank account since a new store manager was hired. The manager is responsible for manually preparing daily bank deposits, which generally include a large number of checks, for processing at a bank branch in the same shopping mall as the store. Which of the following should West Coast Retail Shop implement to improve the available balance in its bank account?

While revising the investment policy, the CFO performs a sensitivity analysis for the company’s cash flow from investments, and identifies that increasing the maximum dollar value for bond purchases will improve returns by 10% on average, all other variables being equal. What issue will the CFO now need to address in the investment policy?

Company XYZ offers a retirement plan wherein the value of the plan’s assets and liabilities is measured separately. The plan’s funding and valuation can have a significant impact on the financial condition of the company. Company ABC offers a retirement plan wherein the amount owed to the participants at retirement is based solely on the account balance at the time of withdrawal with participants often bearing the responsibility for managing the investments in their account. Which of the following BEST describes the above two retirement plans and which act governs them?

A hamburger patty supplier receives an order from ABC Burgers located in Minnesota. The supplier’s policy is to bill upon fulfillment of the order and not at delivery. ABC Burgers pays upon receipt of goods. A blizzard has closed the manufacturing facility and roads; delivery will be delayed by two days. Which type of float occurs between the receipt of an invoice by ABC Burgers, including the credit period, and the time ABC Burgers’ account is debited?

XYZ Company is a publicly held manufacturing company that has decided to branch out into the international market. Five million dollars is needed to set up management and hire the factory workers, $2 million for various government certifications in order to begin business in Poland, and $1 million for miscellaneous expenses. While looking for funding, XYZ found that local banks in Poland were not willing to provide financing without which of the following?

Company X has asked its banking partner for a recommendation on which type of bank account would be best if it has excess funds that are not required for daily cash management. The company determined the excess cash flows by using the short-term cash forecasting distribution method. Company X will require a return on these funds. Which account is recommended?

USA Tires, LLC is a U.S. company that manufactures a high performance tire. It has $500 million in annual domestic sales. Customer A is located 50 miles from the USA Tires warehouse. Customer A orders 1,000 high performance tires per month at a price of $50 per tire. It has credit terms of 30 days. Customer B is located 40 miles from the USA Tires warehouse. Customer B orders 1,000 high performance tires per month at a price of $60 per tire. Customer B has credit terms of 20 days. Which legislation is being violated in the scenario?

The CFO asks the Treasurer to create a new collections and concentration policy for their company. Following implementation of the policy, the company finds that reporting of receivables values is taking 10% longer, with no improvement in the company’s cash flow or liquidity. What step in developing the policy could have been executed better?

MCA, Inc. upgraded the Treasury workstation that had been in place for two years and used data from that 24-month period to develop a new short-term forecast. A trend factor was applied to controlled disbursements of 97% on a month-by-month basis and the variance to actual disbursements is less than 1%. Which of the following model validation techniques was utilized?

Which of the following is a KEY objective when instituting a collection and concentration policy?

XYZ Company experienced a substantial monetary loss due to over exposure to one particular sector of the stock market. The Treasurer had invested in companies tied to five different sectors, but violated the company investment policy by exceeding a 10% limit for any sector. In developing its investment policy, what should XYZ Company have considered to prevent this scenario?

A treasurer decides to use notional pooling across wholly-owned multiple legal entities instead of wiring money between entity accounts. What specific section in the company’s policy allowed the treasurer to make this decision?

Company XYZ is a manufacturer of industrial equipment and has enjoyed a large percentage increase in profits from a small increase in revenues. Sales recently plummeted resulting in steep decline in profitability. Which of the following BEST describes the cost structure of the company?

An individual has just inherited several million dollars and has decided to purchase the stock of a telecommunications company to diversify his portfolio. Before purchasing shares, he would like to do some company-specific research to determine which company to select. Examples of the information the individual wishes to obtain are financial statements and disclosures, company organizational structure, code of conduct, pending litigation, and profiles of the board of directors. Who would be the BEST person to contact to obtain all this information?

When a buyer receives goods, but payment is not due to the supplier until some later date, this is defined as:

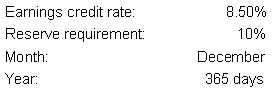

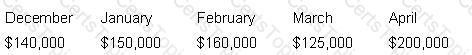

Based on the following information, how much money will XYZ Company owe the bank for monthly service charges after the earnings credit is applied?

Average Ledger Balance $500,000

Deposit Float$10,000

Reserve Requirement10%

Earnings Credit Rate5%

Monthly Service Charges$5,000

Days in month30

XYZ Company is a U.S. based company that has just issued some euro-denominated bonds in London. The bonds have a duration of 10 years at a rate of 3.5% with a par value of EUR 50 million. An FX swap contract was created on the date of the issuance in EUR/USD, with a spot rate of 1.2908 and a forward rate of 1.1102. This bond is subject to what type of risk?

ABC Company’s Treasury department outsourced its overnight investment duties to XYZ Money Management. XYZ placed the funds received from ABC into corporate commercial paper, which has recently gone into default after numerous ratings downgrades. The investment policy of ABC Company states that all investments must be in investment grade commercial paper; however, the agreement gives XYZ the ability to make exceptions with the approval of the Treasurer of ABC Company. The Treasurer was never notified of the ratings downgrades. What role or responsibility, if any, was violated with regards to the investment policy?

A U.S. bank is actively trying to establish its operations in an emerging market country, but is not experiencing much success due to differences in the business culture. To gain some market share, an executive of the bank decides to give the son of a local dignitary a highly paid position in the organization. Furthermore, the dignitary is a person of interest on various terror watch lists. Sanctions can be placed on the bank because the executive did NOT establish compliance with which of the following?

The Treasurer at ABC Company currently uses an in-house company-processing lockbox center. The Treasurer has asked for an analysis to determine the major advantage of using a traditional check/mail-based lockbox system. ABC receives 287,000 payments per month and hired seven additional staff members to process the payments in-house. Additionally, $389,000 was invested in the equipment used to process the payments and NSF checks have decreased 7% since using the in-house center. The equipment’s current market value is equal to its book value. What major advantage should the analysis indicate?

Based on the following information, what is the required collected balance to cover all monthly service charges?

Deposit Float$10,000

Reserve Requirement5%

Earnings Credit Rate15%

Monthly Service Charges$6,000

Days in month30

What should a company’s senior management consider in their payment policies to eliminate the co-mingling of funds for payables, receivables and foreign exchange transactions?

Which of the following is a component of a company’s operating budget?

What type of insurance provides payments to an organization if it is unable to continue operations for some period due to an unforeseen event?

Under the strict cash basis of accounting, revenue is recorded when:

The PRIMARY difference between defined benefit and defined contribution pension plans is whether the employee or the employer:

The before-tax cost of long-term debt is 10% and the cost of equity is 12%.

The marginal tax rate is 35%. The company's weighted average cost of capital is:

All of the following are basic considerations for balance compensation by a company EXCEPT:

Advantages of writing checks locally on a centralized disbursing bank include all of the following EXCEPT which statement?

A telecommunications company has decided to sell its call center hosting division. This is an example of what type of financial decision?

Which cost benefit analysis technique uses the methodology to find where the present value of each project’s cash inflows equals the present value of each project’s outflows?

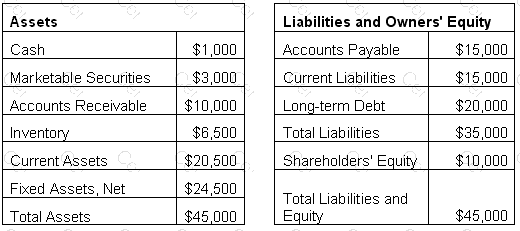

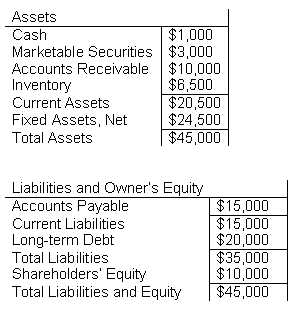

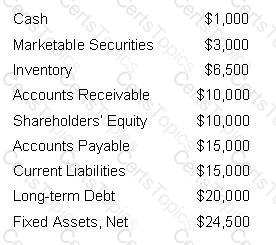

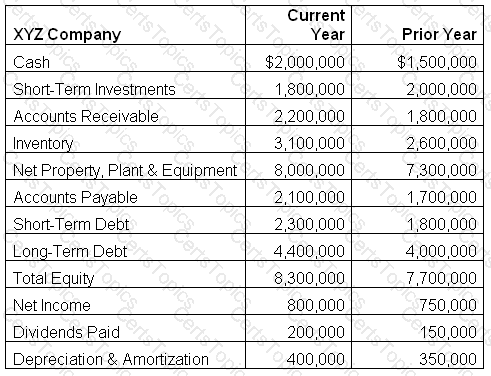

The following information about a company is at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%. The company's current ratio is:

The amount of the discount required to renegotiate credit terms in EDI depends on which two of the following?

I. Present value impact of the timing change

II. Credit risks involved

III. Revolving credit agreements

IV. Transaction costs savings

Which of the following credit terms would be MOST appropriate for a seasonal product that a manufacturer wants to sell to a retailer during the product's off-season?

Refer to the following information about a company at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%.

What is the company's long-term debt to total capitalization ratio?

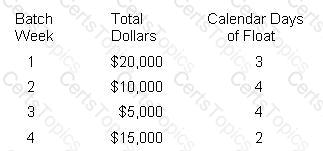

The lockbox receipt records for one 30-day month are provided below. The opportunity costs are 10%.

What is the annual cost of float rounded to the nearest dollar?

All of the following would encourage a company operating nationwide to develop multiple banking relationships EXCEPT:

A United States company must remit a dollar royalty payment to its Japanese subsidiary. Cash settlement of the payment would typically be made by which of the following?

ABC Company is a net borrower with a weighted average cost of capital of 11.5%. What kind of bank fee arrangement is it likely to prefer?

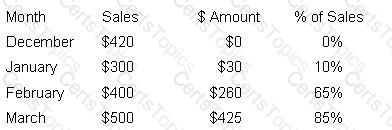

ACCOUNTS RECEIVABLE AT THE END OF MARCH

On the basis of the accounts receivable balance pattern above and April sales of $600, the cash flow forecast for April is:

A digital signature cannot be forged if:

Which method of financing would a company use to establish a wholly owned subsidiary to perform credit operations and obtain accounts receivable financing for the sale of products?

Company A has operated a Pension Plan since 1985. Despite a recent surge in asset values, the plan remains significantly underfunded. With the passage of the Pension Protection Act of 2006, Company A will be need to:

A company has $75 million in adjustable-rate debt, $25 million in fixed-rate debt, and $50 million in accounts receivable. If the company is concerned that interest rates will rise, which of the following would be the BEST interest rate derivative?

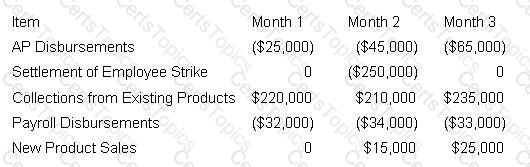

Company A anticipates the following cash inflows and outflows for the next three months:

If the company's treasurer is preparing a cash-flow projection for Month 2, and he is focusing purely on items that can be projected with a fair degree of certainty, what will the net projection be?

Which of the following is an example of using cash forecasting for liquidity management?

A trader of ABC Bank executed and audited his own trades. Assigning these two functions to the same person introduced which one of the following risks to the bank?

When a company must determine the optimal mix of long-term borrowings versus common equity, it is making which of the following types of corporate financial decisions?

Which of the following types of payment transactions requires the authorization of both the initiating and the receiving party?

The delay between the time a check is deposited and the time the company's account is credited with collected funds is known as:

Which of the following services allows a bank to match checks presented for payment against company check issuance data?

A treasurer is evaluating a project that will cost $1,000 but will return cash flows of $225, $225, $300, $750, and $750 in years 1 through 5, respectively. The company’s interest rate on its debt is 10% and its marginal cost of capital is 15%. What is the Net Present Value (NPV) of this project?

A comprehensive payables service can do all of the following EXCEPT:

A bank's reserve requirement on demand deposits is 10%, and its earnings credit rate is 6%. If a company uses bank services amounting to $2,600 and has an excess of $550 in earnings credit, what is the average collected balance in the account based on a 30-day month?

Which of the following statements are true about the use of different discount rates for different types of projects?

I. Low-risk, short-term projects may be evaluated by using a short-term opportunity cost.

II. High-risk projects may be evaluated by using a discount rate that is greater than the company's normal opportunity cost.

III. A short-term investment (or borrowing) rate may be used as the company's short-term discount rate.

IV. The use of a lower discount rate for riskier projects forces riskier projects to earn higher rates of return.

Three college roommates open a fast-food restaurant chain after graduation. They decide to offer a 401(k) plan to all of their 700+ employees and a defined benefit retirement plan for themselves and their six Group Vice Presidents. If the company initially funds the defined benefit plan with $10 million and is in the 32% tax bracket, what is the after-tax cost of the funding?

MICR encoding errors may be detected by all of the following TMS modules EXCEPT:

XYZ Company is a net borrower. Its cost of funds is 5.0%, its earnings credit rate is 3.0%, and the reserve requirement is 10%. Average service fees are $50,000 per month. Its average ledger balance is $2,000,000, and its average collected balance is $1,000,000. What are the collected balances required to pay for services during a 30-day month?

On a company’s financial statements, an increase in accounts receivable is reflected as a(n):

In which of the following instances does the clientele effect come into play?

A company sells products to customers on credit, generating accounts receivable. The company uses the accrual accounting method. Once the company collects good funds from its customers, what is the impact on the financial statements of the company?

Which of the following would be MOST suitable for a risk-averse electronics manufacturer that uses copper in many of its components?

A company’s capital structure includes $800,000,000 in total capital, of which $200,000,000 comes from debt. The firm’s after-tax cost of debt is 6%, and its cost of equity is 12%. The marginal tax rate is currently 40%. What is the company’s weighted average cost of capital?

An arrangement in which a borrower makes periodic payments to a separate custodial account that is used to repay debt is known as a:

A U.S. exporter sells goods to a foreign buyer in U.S. dollars and wants to guarantee that payment is made by the buyer. The exporter would MOST LIKELY require a(n):

A telecommunications company receives a profit of $587,542 from its cellular phone production unit in the year after investing $962,870 in a new product line. What is the first year return on its original investment?

The accounting requirement that a product’s selling costs be recorded in the same period as the product’s revenue is recorded, regardless of when the cash is paid, is an example of the:

ABC Company is a national retail company and uses XYZ Bank for its collections and payroll services. XYZ has recently experienced financial problems; what is the greatest risk to ABC Company?

Account analysis statements should be examined for which of the following reasons?

I. To verify volumes processed

II. To determine daily cash shortages

III. To verify the accuracy of bank service charges

IV. To ensure that company-initiated transactions have occurred

The KEY decision in using CCD+ and CTX formats for B2B payments is:

The MOST common way that companies structure their treasury operations is as a:

A foreign company could raise capital in the United States using an:

Which of the following is a characteristic of giro systems used in countries in Europe?

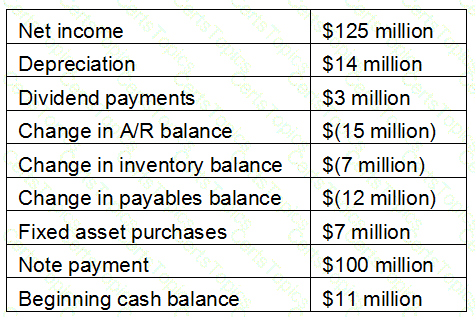

Use the financial statement for XYZ Company in the exhibit to answer this question.

What is the cash flow from operating activities for the current year?

Which of the following is subject to transaction exposure?

Which of the following is NOT a key area to consider when establishing treasury policies?

Regarding dividends, on which of the following dates would a company's current assets be reduced?

Company XYZ has determined that its weighted average cost of capital is 12.5%. The capital structure of the company is made up of 75% equity and 25% debt. The before-tax cost of debt is 10%. Given a tax rate of 34%, what is XYZ's cost of common stock?

A company has a line of credit and a bond trustee agreement with a bank. To prevent a decline in the company’s bond rating from having a negative impact on the company’s line of credit, the bank should have which of the following in place?

Company XYZ is not sure which direction interest rates are headed. Which of the following would be MOST suitable?

Kahuna Boards Co. has just experienced a very profitable year and wants to share the success with its shareholders. In order to pay dividends, a sequence of events must occur. Which of the following chronological sequence of events is correct?

1. Stock is sold without the upcoming dividend attached.

2. Dividend is paid.

3. Board of directors announces the dividend.

4. Holders of record are specified.

A call option for a company has an exercise price of $50. The stock is currently trading at $60. At maturity, what should an investor who paid $3 for the option do?

A company is starting a project to redesign its cash management information systems. What would be an important tool in this effort?

A distribution business has used several bank loans to finance its expansion plans. After a fire destroyed the company’s facility and inventory, it went out of business due to the loss of revenue during the month it was closed. What type of insurance coverage should the company have had to prevent its demise?

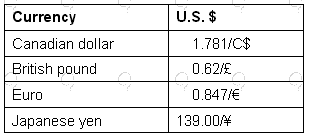

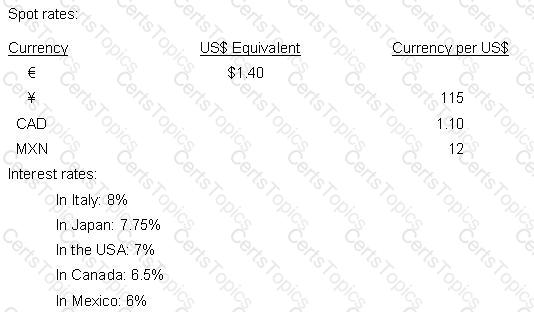

On the basis of the following exchange rates,

which of the following currency amounts has the greatest value in U.S. dollars?

Company A regularly modifies its capital structure by repurchasing stock. Which one of the following is a true statement?

A company plans to issue additional equity within the next 12 months but needs to issue debt at a low interest rate now. Which of the following instruments would BEST meet this objective?

The Governmental Accounting Standards Board (GASB) is the authoritative standard-setting body for which of the following?

A Chicago meat processor is concerned about the volatility of pork belly prices. Which of the following derivative products would be used to fix these prices within a given range?

An instrument that gives the right to buy a stated number of shares of common stock at a specified price is known as:

Company A is a large public company with annual revenue of $1.2 billion and high fixed costs. Its stock is listed on the New York Stock Exchange. Company B is a mid-sized company with annual revenue of $100 million and low fixed costs. Its stock is listed on the NASDAQ. Which of the following statements is MOST LIKELY to be true when comparing Company A and Company B?

The Federal Reserve can increase the money supply by:

Netting is used by which of the following as a cross-border payment technique?

A real estate development company has excess cash that it would like to invest in one of its properties:

Property A has shown an ROI of 40%, a residual income of $25,675, and an EVA of $32,678.

Property B has shown an ROI of 45%, a residual income of $27,635, and an EVA of $29,523.

Property C has shown an ROI of 55%, a residual income of $22,658, and an EVA of $30,678.

Property D has shown an ROI of 52%, a residual income of $19,675, and an EVA of $31,523.

In which property should the company invest?

The goal of a successful investor relations program is to ensure:

A company is looking for a way to finance their inventory. What is the BEST funding match?

The key parties involved in a disaster recovery plan are generally classified as internal resources or external counterparties. When evaluating the risks of both parties, which of the following can be assumed?

A construction company just received a notification from its bank advising it of an altered dollar amount on a check. This notification is MOST LIKELY the result of:

A company with a relatively poor credit rating borrows most of its funds with short maturities. They may want to change its exposure to interest rates to more correctly reflect the long-term nature of the projects it is funding. Or, they may believe that long-term interest rates are going to rise, causing it to seek protection against the impact of higher interest rates on its balance sheet. Which of the following would be a solution?

Which of the following statements is typically true about a net settlement system?

The rate of interest commercial banks charge their best credit rated customers is called the:

If the Federal Reserve Board increased the discount rate, you would expect:

Company X, a US based multi-national, is exploring the option of locating a subsidiary in another country where there has been some historical risk of expropriation of local assets of foreign corporations. Therefore, as part of the risk assessment process the company must specifically quantify the:

Which of the following is a source of short-term financing?

Which of the following payment types is at the greatest risk for fraud?

A company has large, ongoing short-term financing requirements with a maximum horizon of 250 days. It has a good credit rating and would like to use the least expensive source of short-term debt to finance its needs. The Treasurer might recommend which of the following?

Which of the following could be considered a weakness of a forecast derived by regression analysis?

In an organization with personnel limitations, which of the following strategies should be considered to mitigate cash management system risk?

Which of the following industries is MOST LIKELY to use a sophisticated cash concentration system with multiple banks as part of its cash management system?

A company is concerned that investor dissatisfaction could lead to a rapid change in its board membership. To prevent this, which of the following strategies should the company employ?

The principal roles of corporate finance include which one of the following combination of functions?

The treasurer of a corporation is negotiating with one of his/her suppliers to allow the corporation to have 30 days to pay the supplier’s invoices. The treasurer is arranging:

Unrealized holding gains and losses arise when trading securities are:

In order to be defined as independent, a corporate director:

A treasurer overhears several employees talking about selling their company stock before a pending deal impacts the stock negatively. What action should the treasurer take to control this behavior in the future?

A treasury manager expects the price of a commodity to be highly volatile between the time of option purchase and exercise. Which option style would provide the greatest flexibility?

A national retailer’s cash management system includes a field deposit system using multiple banks. To limit the impact of a failure of one of these banks, a cash manager should:

The goal of investor relations is to:

Underfunded pension obligations can be reduced by:

To arrive at today’s projected closing cash position, a cash manager starts with:

Which of the following statements BEST applies when evaluating fees in an RFP for bank services?

Which of the following must be considered when designing the basic framework for a cash management system?

Which of the following is NOT an operational risk?

The combination of difference in condition (DIC) insurance and umbrella insurance:

A large U.S. company is planning to fund its Canadian subsidiary. Currently, the Canadian dollar is trading at CAD 1.25 per U.S. dollar, and the U.S. dollar is expected to depreciate in the near term. To manage this FX exposure, what technique should the company implement?

Two critical factors in determining an operational risk management strategy for a company are:

An accounts payable manager has been mandated to accept all trade discount opportunities with an effective cost of discount above 25%. An invoice has been presented and approved for payment with terms of 3/5, net 30 days. What is the difference between the effective cost of discount offered, and the 25% rate set by the company?

Consolidation and specialization in the financial services industry have made financial institution and financial service provider selection a(n):

Today’s modern cash management systems would include which of the following?

A multinational company may use which of the following to locate profits in subsidiaries in low-tax countries?

The exchange of a fixed interest rate cash flow for a floating interest rate cash flow with both interest rates in the same currency is an example of:

The PRIMARY objective of a corporation is to:

Which of the following factors will allow a company to decrease the amount of collected balances required to compensate its bank for services?

In a large company, the person who normally oversees both the treasury and the accounting functions is the:

Which of the following ACH formats is commonly used for consumer payments such as deposits of payroll?

When a supplier uses evaluated receipts settlement (ERS), which of the following statements is true?

All of the following are reasons to use a confirmed irrevocable letter of credit EXCEPT concern about:

A merchant, wanting to accept credit cards as payment method, will negotiate its fees with which of the following participants?

A company has a $300,000 credit line of which $200,000 was the average amount outstanding for the year. The terms of the loan include a 1/2 of 1% commitment fee on the unused portion, an interest rate of 10%, and a compensating balance requirement of 2% of the total credit line. The company's compensating balances are funded from credit-line borrowings.

If the company negotiates to eliminate the compensating balance requirement and the average borrowings remain at $200,000, the annual interest rate would be:

A company's investment guidelines typically restrict all of the following EXCEPT:

A company has a $300,000 credit line of which $200,000 was the average amount outstanding for the year. The terms of the loan include a 1/2 of 1% commitment fee on the unused portion, an interest rate of 10%, and a compensating balance requirement of 2% of the total credit line. The company's compensating balances are funded from credit-line borrowings.

What is the effective annual interest rate on the net usable funds?

Which of the following MOST often contributes to the misinterpretation of DSO?

In most countries other than the United States, which of the following is used to compensate banks for services provided?

Major Manufacturing Inc. (MMI) is a manufacturer of customized restaurant equipment. MMI's supplier relations policy is to take advantage of trade discounts, when available. All suppliers offer payment terms of 1/10, net 30. MMI invoices customers at the end of its 30-day manufacturing cycle. Which of the following is the correct chronological sequence of the events listed?

1. Customer invoice is sent.

2. Supplier payment is sent.

3. Customer payment is received.

4. Order is shipped.

5. Customer order is received.

6. Supplier order is placed.

Which of the following types of payments would NOT be included in cash flow forecasting?

ABC Company is considering investing in new production technology. ABC has projected that the investment would add $5,000,000 in additional operating profit and that the resulting balance sheet would show $7,000,000 in long-term debt and $11,000,000 in total equity. ABC has a 34% tax rate and a 10% WACC. Which of the following is the investment's EVA?

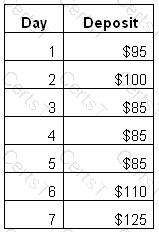

This question is based on the following data describing a company's actual deposits.

If a five-day moving average is used, what was the deposit forecast for day six?

Which of the following would MOST LIKELY cause a decrease in a company's deposited checks availability?

"Fees" in Country Y, which would be considered bribes in the United States, are ingrained in the commercial culture. A U.S. company doing business in Country Y:

The treasury analyst at RST Corporation has been asked to forecast cash levels for the company’s year-end balance sheet. The analyst has been given the following information:

What should the analyst project as the upcoming year-end cash balance?

A company purchases a machine tool with an expected life of 3 years. Under the accrual accounting method, the equipment would be treated in which of the following ways?

A manufacturing company is working to improve its cash conversion cycle. Factory production has increased over the last year to increase inventory levels. They have an inventory turnover of 3.1 and asset turnover of 5.0. The company has a days’ payable of 30 and a days’ receivable of 60. It has started enforcing its net 30 terms and placed customers with balances outstanding more than 45 days on credit hold. As a result, the company collected receivables quicker but it suffered a 10% loss in sales. What can the company do to reduce its cash conversion cycle?

A large multinational company recently implemented new processes to automate its treasury operations. If these changes were the direct result of comparing the company's practices with those of other companies, the activities could be considered an example of which of the following?

I. Liquidating

II. Re-engineering

III. Benchmarking

IV. Forecasting

A U.S. government agency issues securities transfers using Fedwire Book-Entry Securities System. The first transfer request of the day in the amount of $1 million is sent at 1:00 p.m. EST, the second one for $2 million at 3:30 p.m. EST, the third one for $3 million at 4:30 p.m. EST and the fourth one for $4 million at 5:00 p.m. EST, all on the same day. Which of the following represents the total value transferred at 5:00 p.m. EST that day?

A company transfers funds from its remote accounts by ACH with a one-day settlement and is notified of a same-day credit of $100,000 in one of its accounts. A wire transfer costs $27.75 incrementally. Assuming a 360-day year, which of the following is the minimum rate of interest that must be earned on these funds to justify the cost of a wire transfer?

A merchant closes its day with a total of 100 credit card transactions of an average ticket value of $100. The interchange reimbursement fees are 2% and transaction fees are $0.05. If this merchant receives gross settlement, what would be the value of deposit to the account for that day?

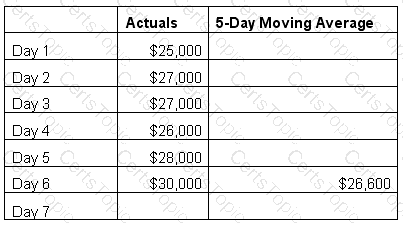

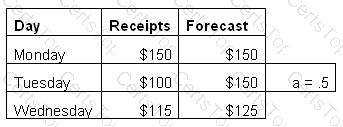

Company XYZ uses exponential smoothing to forecast its daily lockbox receipts. With the help of a statistical computer program, the company has determined that the smoothing constant is 0.35.

Using the data in the table, what is the exponential smoothing forecast for Day 7 (rounded to the nearest whole $)?

A small import/export company, XYZ Company, has recently set up an account with a German firm. The contract between the companies states that XYZ is to be paid as soon as all documents are in order showing that the transaction terms have been met. Which of the following forms of payment drafts would be MOST appropriate for XYZ?

XYZ Company is considering different methods of concentrating cash from its subsidiary accounts to its main operating account. It uses short-term borrowings with a rate of 7% to fund daily operations, and the reserve adjusted earnings credit rate on its subsidiary accounts is 1%. A review of its bank fees shows that wires (same day transfer) cost the XYZ Co. $7.00 each while ACH debits (next day transfer) cost $1.25 each. If the primary objective is to minimize costs, what must the transfer amount be (rounded to the nearest whole $) to justify the use of a wire transfer instead of an ACH to concentrate the funds?

Which two of the following are necessary to calculate average collected balances?

I. Deposit float

II. Reserve requirements

III. Ledger balance

IV. Earnings credit rate

Which statement is true about private placements compared to public offerings?

An option can be exercised in the market at its:

Which of the following are KEY issues to be considered when establishing a shared service center (SSC)?

I. Selecting the location

II. Comparing an SSC structure to outsourcing of a process

III. Choosing and implementing the technology for SSC

IV. Choosing the collection bank

All of the following are advantages of using traditional financial ratios for analysis EXCEPT:

Company XYZ sends an ACH debit file valued at $300,000 with an average item value of $1,000. The file settlement date is March 10. The file contains no duplicate items and items are split equally between corporate and consumer items. One percent of consumer items and 2% of corporate items were returned. What would be the final net settlement value for Company XYZ?

Assuming a marginal tax rate of 36%, the taxable equivalent yield for an investment with a tax-exempt yield of 3% would bE.

If a company uses accrual accounting, deferred taxes are reported on which financial statement?

A short-term bank line with $20 million of unused capacity and an investment in an overnight money market fund are both forms of which liquidity requirement?

The term "factoring" refers to a:

Which of the following is true about disbursement ZBAs?

Which of the following is LEAST important when a cash manager determines a company's short-term cash position?

Which currency will sell at the greatest discount in the forward market against the U.S. dollar?

Which of the following is a type of borrowing between a company and a lender in which the paperwork connected with it is used to simplify the lending process?

On the basis of the information above, what level of net collected balances is necessary to compensate a bank for $1.00 worth of services?

Which of the following is considered an important factor when selecting a financial service provider?

Compared to a letter of credit, a documentary collection is:

The Sarbanes-Oxley Act of 2002 requires that a public company’s financial statements be certified by the company’s:

A small group of investors is purchasing a company using a large amount of debt. This group is intending to sell off pieces of the acquired company to other firms that it believes can take advantage of potential synergies. What is this type of a transaction more specifically known as?

What is the MOST appropriate definition of working capital?

Company J is looking to perform an A/R cash analysis based on the following sales information:

60% of sales are collected within two months after sale. After three months, $135,000 of January's sales were collected. What was the dollar amount of January's sales collected in April?

Multinational corporations repatriate funds from foreign operations through which of the following?

Which of the following factors would the cash manager consider when deciding whether to make a payment via Fedwire or ACH?

1. Cost of the payment

2. Payment due date

3. Availability of customer's funds

4. Loss of float

When will a depositor receive ledger and collected credit for a western check deposited at 2:00 P.M. Wednesday?

Ledger Credit - Collected Credit

A lockbox provider offers which of the following advantages over a company processing center?

I. It increases the company's operational control.

II. It produces processing economies of scale.

III. It allows for external audit controls.

IV. It reduces collection float.

In a large company, the financial planning function typically falls directly under the responsibility of the:

When a company creates future receivables and/or payables that are denominated in a currency other than its home or functional currency it is faced with:

A wholesale lockbox system does which of the following?

In the event of bankruptcy and the subsequent liquidation of issuer's debt, in what order, from first to last, will the following be repaid?

1. Senior secured debt

2. Senior subordinated debt

3. Junior secured debt

4. Junior debentures

LLZ Company manufacturers metal detectors in California at a cost of $9 per unit. The most expensive component to make is the sensor which goes in the finished product. The cost is $5 per sensor. Last month LLZ acquired a company in Mexico that makes the sensors for $1 per sensor. LLZ plans to move all sensor manufacturing operations to the factory in Mexico. What is the movement of this cost saving process called?

A multidivisional domestic company with centralized treasury decision-making can potentially utilize intra-company lending to:

A globally diversified manufacturing company can manage its liquidity more effectively by:

In a maturity matching financing strategy, which of the following is financed using short-term sources?

If the spot foreign exchange rate and the forward foreign exchange rate are the same between two countries, which of the following is implied?

Which of the following techniques would MOST accurately predict a company's daily cash position?

A multinational corporation has a successful subsidiary in a country that taxes cross-border dividend payments at 72%. Collections on accounts receivable average 90% per month, and the average rate on local government bond investments is 2.5%. What would be the BEST method for the company to repatriate local profits?

Which of the following is a regulation that is having a major impact on the treasury profession?

What is a KEY reason that both a lessee and a lessor would enter into a lease financing agreement?

A utility company is evaluating whether or not it should build a new plant. The process of reviewing the quantitative and qualitative factors are an example of which finance function?

A firm’s air conditioning unit breaks down unexpectedly and must be replaced immediately. What type of liquidity requirement is this an example of?

The cash manager for a company is creating a list of transactions that should be considered when determining the daily projected closing cash position. Which of the following transactions should be removed from the list?

A U.S. company is selling product for US$10,000 to a Canadian company with payment in Canadian dollars. The exchange rate has been booked at C$1.45/US $1 for payment upon delivery in 15 days. The Canadian dollar is forecasted to weaken within this period. This is an example of A.

An olive oil producer in Macedonia is arranging for shipment of its product to an international distributor. To support this activity, the company arranges for export financing because:

ABC Company offers trade terms of 2/10 NET 30. For several reasons, ABC has decided to eliminate the requirement for a letter of credit from one of its customers. If ABC puts the customer on open book credit, what is the MOST LIKELY outcome?

All of the following are discounted instruments EXCEPT:

Which of the following ONLY measures the time required to convert a credit sale into cash?

In order to maintain internal control best practices, how often should an organization reconcile their investment statements?

Which one of the following is true of capital repatriation for multinational companies?

A New York company wishes to use its treasury management system to send US funds to its London UK subsidiary. Which one of the following enables the same day settlement of funds transfer?

Investors typically require a higher yield as compensation for holding securities that have:

Treasury uses which of the following internal sources of information in its daily operations?

A firm that thinks interest rates are going to rise is likely to:

A CFO is concerned about cash flow and the risk of defaulting on the debt covenants due to the ongoing recession. The company is a net borrower with a syndicated credit agreement consisting of:

-an operating loan available in USD and CAD

-a commitment of an $80.0 million USD long-term loan with a quarterly repayment of $1.5 million

What asset financing strategy should the CFO utilize to reduce overall financial risk?

If a bank has a 0% reserve requirement, a 31-day month, and an earnings credit rate of 3.5%, which of the following is the approximate level of collected balances required to support $1,000 worth of bank service charges?

What is the primary weakness of a risk management policy that includes risk control without specifically providing a plan for risk financing?

A privately held company is planning to issue an IPO. If the company decides to do so, which of the following will MOST LIKELY result?

Which of the following forms of payment is covered by Regulation CC?

Which of the following is the MOST accurate statement regarding the passage of the Sarbanes-Oxley Act?

Of the following card transactions, which would likely incur the highest interchange fees?

The treasurer of XYZ Company reached out to its local banker for a $7MM line of credit. The banker is able to offer the facility for an all-in interest rate of 6% for a service fee of 45 basis points. Additionally, there is a commitment fee of 75 basis points for the unused portion. XYZ uses $5.5MM of the facility in the first year. What is the annual borrowing cost for XYZ (round to two decimal places)?

Which of the following concentration transfer alternatives provide the fastest availability of funds?

An investor purchases securities that mature beyond the date when cash is required. The investor intends to sell the investment to meet the cash flow need. This strategy works best when:

A company launches an innovative product and notices that a competitor based in another country begins to offer a very similar product. After investigating, the company discovers that its intellectual property was stolen after a foreign government's employee gained access through a weakness in the company's treasury management system (TMS). To which type of risk has the company been exposed?

The telecommunications network used to transmit international payment instructions is called:

A U.S.-based importer, whose functional currency is USD, has an FX exposure in GBP related to a GBP denominated payment it will need to make in 120 days. As the company's treasurer is uncertain as to the exchange rate movements between the two currencies, he has decided to hedge the exposure. To do so, the treasurer has decided to purchase futures contracts at today's GBP/USD FX rate and will hold the contracts for 120 days until which the position will be liquidated in order to settle the GBP payable. If the GBP were to strengthen against the USD over the 120 day holding period, will this result in a positive or negative mark to market change on the futures position? Will this increase or decrease the total cost of the USD denominated payable?

What comprehensive set of reform measures was developed in order to strengthen the regulation, supervision, and risk management of the international banking sector?

What is the impact, if any, on a company's cash conversion cycle if smart safes are used in all of its retail locations, including those that are remote?

Based on the data set, how much money will ABC Company owe the bank for monthly service charges after the earnings credit is applied?

The treasury objectives of Company ABC are to ensure liquidity and produce a profit. The board of directors is allowing the treasury department to actively take a position on the direction of the market to make a profit. Which strategy is the company employing?

A large mature, diversified. publicly traded company sells the smallest of its business segments to a strategic buyer for cash. It uses the proceeds to pay off all bank debt and subordinated debenture debt on its books. The company believes the stock is trading at a reasonable price and continues to pay a regular steady dividend to shareholders. Management's strategy is to embark on an aggressive growth plan including a major acquisition.

Based on the above information before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

ABC, Inc. is a pharmaceutical company operating globally. Which of the following payment methods is arranged from the most seller protection to the least?

An investor relations manager reports to the:

Concerning the financial management function of a company, which organization sits at the center of the financial supply chain?

When the stocks of two firms are surrendered and new stock is issued in its place, this is known as:

A company has selected a specific project for investment. If the weighted average cost of capital (WACC) used to evaluate the project results in a negative net present value (NPV), which of the following will occur?

Exhibit:

What is the price to earnings ratio for Company ABC?

Company XYZ sells 100% of its accounts receivable in a no-recourse factoring arrangement. ABC Ltd, a customer of Company XYZ, owes $10,000 for products purchased on March 31. Company XYZ factors its receivables including this purchase on April 15. On April 20, ABC Ltd files for bankruptcy. What is the effect of the bankruptcy filing on Company XYZ?

To monitor financial institution service quality, a company would use all of the following measures EXCEPT:

A U.S. retailer accepts credit card payments. The retailer has written procedures to only accept swiped transactions with the customer's signature. The retailer's acquiring bank has notified the retailer of several losses. What can the retailer do to protect itself from future charge-backs?

A disbursement check was intercepted in the mail, fraudulently altered, and subsequently cashed for $1,000 more than it had been written. The fraud was not detected until two months later, when the vendor phoned about late payment. Which of the following could have detected the fraud sooner?

A treasury manager at a multinational manufacturing corporation assigned a team of analysts to re-engineer the company’s FX exposure management program. Which of the following alternatives would BEST accomplish this objective?

A company is looking to improve its collection rate of returned checks. If the company implements re-presented check entry (RCK) with its bank, it might see a reduction in what type of returned items?

A bank is evaluating the credit risk for a company seeking to optimize costs and originate a high volume of outgoing ACH payments. What is the BEST provision the bank should establish to control its credit exposure?

Which of the following is a tool that companies use to obtain a quantitative rating of a financial institution’s level of service?

Money market funds are able to obtain very competitive trading terms because:

Which of the following is true of return on investment (ROI)?

A large retailer is preparing to accept credit cards and anticipates monthly credit card sales of $1,000,000. If the terms with the acquiring bank include bundled allocated fees of 6% and the retailer wishes to delay fee payment as long as possible, what should the retailer do?

A company in the market to purchase a treasury management system (TMS) has issued a request for proposal to evaluate various vendors. One of the evaluation factors focuses on the long-term viability of the vendor. The company may have to choose between an untested new vendor with a superior product and an established vendor with an incomplete product suite. This dimension of the RFP is measuring what type of risk?

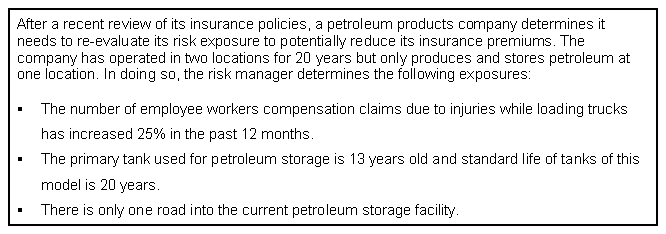

Given the above information,

if the risk manager adds a tank at its second facility, what loss control technique is being used?

A small for-profit, start-up company is designing a retirement plan with the goal of minimizing costs and operating income volatility while providing a qualified retirement savings vehicle. Which of the following would be the BEST choice?

Private companies usually go public by making an initial public offering. What is the term for offering subsequent shares in the market?

A-Plus Company has made arrangements for a new insurance broker to provide products to its employees. Historically, A-Plus Company’s employees made insurance payments via payroll deduction, but the new broker will be collecting payments from employees directly. What will the broker MOST LIKELY use to minimize collection float?

What is the reserve-requirements provision of the Federal Reserve Act of 1913 known as?

JMW Company processes its consumer payments using a lockbox provider. On average 35% of its remittance advices contain encoding errors. JMW Company’s cost for the lockbox provider to process these payments will be least impacted if it uses:

One example of increased use of electronic payments for retail businesses to convert customer checks to cash at the counter more quickly is:

BEA Company has determined its breakeven dollar amount for concentrating remote funds is $550.00. BEA Company has a daily earnings rate of 6% and gains one day of accelerated funds. If a wire costs BEA $35.00 dollars, what is the cost of an electronic funds transfer for BEA Company?

XYZ Inc. has limited cash flow, total liabilities to total assets greater than 52%, and a high WACC. To help meet the goal of lowering their WACC, the company plans to issue several million dollars of private equity to the chairman of the board. If the company proceeds with this plan, the company may:

Which of the following is generally NOT a benefit of financial risk management?

A portfolio manager’s investment policy states that they are not allowed to hold any investments that have extension risk. Which type of investment should the portfolio manager avoid?

Which of the following actions would the CFO of a Canadian multinational conglomerate MOST LIKELY take to repatriate profits from its international subsidiaries?

ABC Company, a leading provider of office supplies, has successfully implemented EDI based on a request from one of its customers. ABC will not only benefit from the strategic alliance that will result, but as more of ABC’s customers adopt the program, ABC will also experience a positive impact on its:

Company XYZ has an underfunded defined benefit plan. Company XYZ is required to provide filings for this plan to all of the following EXCEPT:

Using a digital certificate when accessing a financial services provider is one way to reduce what kind of risk?

EDI infrastructure includes which of the following four PRIMARY components?

JKL Company has been successful in shortening the time associated with its mail float, processing float and availability float. JKL Company will experience which of the following as a result of these improvements?

Loss exposures related to treasury management may include which of the following?

Amalgamated Binding Consolidators takes 20 days to convert its raw materials to finished goods, 5 days to sell it, and 15 days to collect its credit sales. What is the company’s days receivable period?

Company XYZ has stable cash flows and sizable assets. The board of directors compared its WACC with its own industry’s averages and determined that it may be at a competitive disadvantage. In order to become more competitive, what action will XYZ MOST LIKELY take?

Which of the following would be considered insurance risk management services?

Which of the following options would be BEST suited for a firm that wishes to pay no premium?

XYZ Inc. is a publicly traded company with revenues of $1B and an operating profit of 7.5%. The treasury organization consists of a treasurer and an assistant treasurer. The assistant treasurer is responsible for the creation and approval of all payments. The treasurer is responsible for compilation of the financial statements. Under Section 404 of the Sarbanes-Oxley Act, what should be viewed as a concern?

Which statement is true about credit unions?

An analyst is performing a lease versus buy analysis on a corporate jet. In the evaluation, a cost is relevant if it is:

The yield curve is inverted. A creditworthy firm considering alternative debt maturities would MOST LIKELY:

Securities sold by companies in an initial public offering (IPO) arE.

A retail brokerage firm is MOST like which one of the following types of financial institutions?

The credit management function is responsible for:

To increase the money supply, the Federal Reserve would increase which of the following?

Which of the following can be considered key responsibilities of daily cash management?

I. Overseeing compensation for bank services

II. Management of short-term borrowing and investing

III. Projecting future cash shortages and surpluses

The time from the deposit of a check in a bank account until the funds can be used by the payee is known as:

A bank uses all of the following to determine whether a company's balances are sufficient to compensate for services EXCEPT:

On the basis of the data above,

what is the forecast for Thursday's cash receipts, under the exponential smoothing method?

Which of the following contributes MOST to the marketability of a security?

Which of the following companies would be MOST LIKELY to use a wholesale lockbox?

Cash management services commonly used outside the United States include which of the following?

I. Interest-bearing deposit accounts

II. Controlled disbursement systems

III. Pooling of bank accounts

The ACH system eliminates float because the:

Which of the following items would be classified as a source of cash on a company's statement of cash flow?

I. Selling, general, and administrative expense

II. Increase in accounts payable

III. Increase in inventory

IV. Depreciation expense

The time between the payor's mailing of a check and the payee's receipt of usable funds is known as:

Insurance companies often use which of the following payment instruments?

The purpose of cash letters is to:

A cash manager invests in Treasury bills for which of the following reasons?

A currency is said to trade at a discount if it is worth:

Which of the following investment instruments is a discount instrument?

Which of the following short-term instruments is used to finance the import or export of goods?

All of the following statements are true about loan participations EXCEPT:

A major toy retailer operates 65 retail stores throughout the Midwest. Which of the following credit terms is MOST LIKELY to be offered to this company by its suppliers?

A high-yield, non-investment-grade security is commonly referred to as which of the following?

When a subsidiary borrows money, the parent, sister subsidiary, or other entity is often used in order to:

Compared to debt, which of the following statements is true about a company issuing equity?

Which of the following factors is NOT used by a cash manager to estimate a target compensating balance?

All of the following statements are true about adjustable-rate preferred stocks EXCEPT:

Treasury management systems help cash managers do which of the following?

I. Reduce borrowing expenses

II. Initiate transfers

III. Determine cash position

IV. Obtain account balances

A grocery store chain would be likely to use all of the following services EXCEPT:

The credit risk in the settlement of a Fedwire is borne by the:

Representations and warranties in a loan agreement refer to which of the following?

The process by which a bank or insurance company guarantees the debt obligation of a borrower is referred to as credit:

An inverted yield curve occurs when which of the following is true?

The PRIMARY objective of the AFP Account Analysis Standard is to help cash managers in which of the following areas?

A KEY feature of municipal bonds is that they are:

The time between receipt of a mailed payment and the deposit of the payment in the payee's account is known as: