A distribution business has used several bank loans to finance its expansion plans. After a fire destroyed the company’s facility and inventory, it went out of business due to the loss of revenue during the month it was closed. What type of insurance coverage should the company have had to prevent its demise?

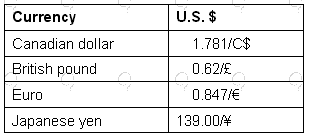

On the basis of the following exchange rates,

which of the following currency amounts has the greatest value in U.S. dollars?

Company A regularly modifies its capital structure by repurchasing stock. Which one of the following is a true statement?

A company plans to issue additional equity within the next 12 months but needs to issue debt at a low interest rate now. Which of the following instruments would BEST meet this objective?