A company has $75 million in adjustable-rate debt, $25 million in fixed-rate debt, and $50 million in accounts receivable. If the company is concerned that interest rates will rise, which of the following would be the BEST interest rate derivative?

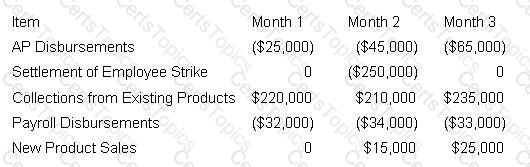

Company A anticipates the following cash inflows and outflows for the next three months:

If the company's treasurer is preparing a cash-flow projection for Month 2, and he is focusing purely on items that can be projected with a fair degree of certainty, what will the net projection be?

Which of the following is an example of using cash forecasting for liquidity management?

A trader of ABC Bank executed and audited his own trades. Assigning these two functions to the same person introduced which one of the following risks to the bank?