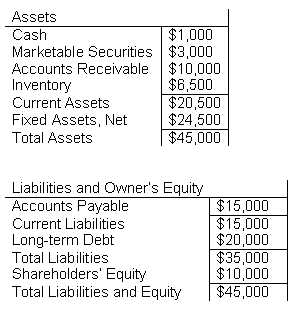

The following information about a company is at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%. The company's current ratio is:

The amount of the discount required to renegotiate credit terms in EDI depends on which two of the following?

I. Present value impact of the timing change

II. Credit risks involved

III. Revolving credit agreements

IV. Transaction costs savings

Which of the following credit terms would be MOST appropriate for a seasonal product that a manufacturer wants to sell to a retailer during the product's off-season?

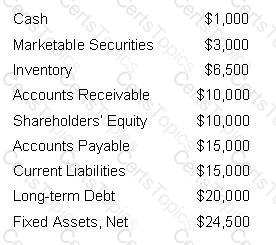

Refer to the following information about a company at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%.

What is the company's long-term debt to total capitalization ratio?