The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

An unbalanced bid methodology can best be used by:

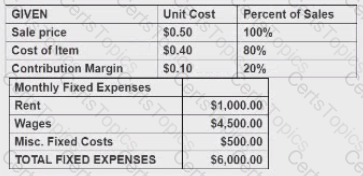

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

It S480 is the target net profit, then the total sales volume (in dollars) is:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

You have been asked to provide ETC information to management. Based on the following information, what is the ETC?

Original Budget = $9,000,000

Actuals to date = $3,513,000

Current estimate at completion = $10,613,000

Actuals for current month = $1,200,000

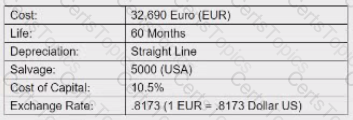

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The equivalent value of an investment alternative in today's dollars is referred to as the: