Answer the following questions about the content of the Commercial Case and the Financial Case for the Pittville project.

Which detail should be explained in the Commercial Case?

Which is an appropriately defined SMART spending objective for improved efficiency of resources?

Which detail should be explained in the Financial Case?

Using the Scenario, answer the following questions about roles and responsibilities on the Pittville project.

Which action should be completed by the sponsor for the Western Area Learning Improvements Programme?

Which statement should be recorded under the Programme and Project Management heading?

Which 2 statements should be recorded under the Proposed key contractual clauses heading?

Using the Scenario, answer the following questions about the Commercial Case for the Pittville project.

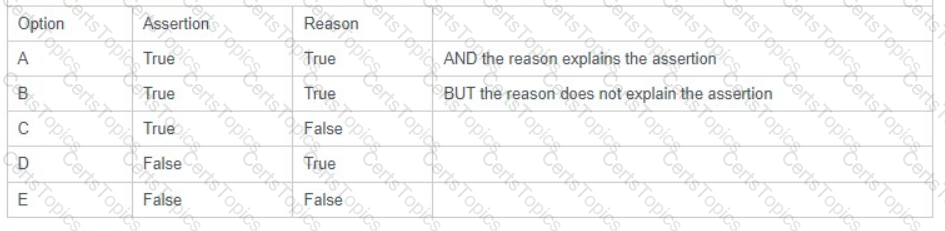

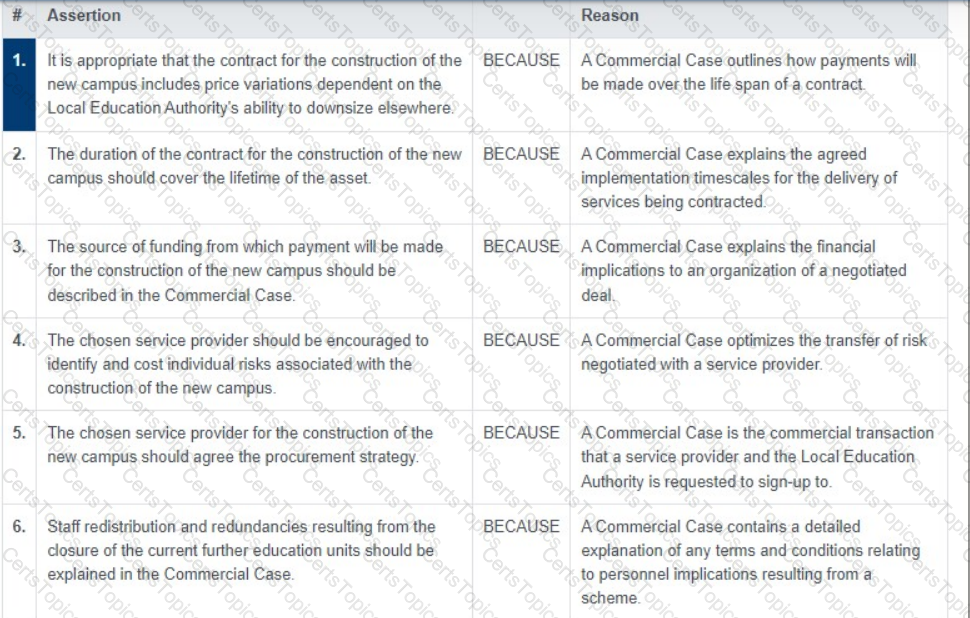

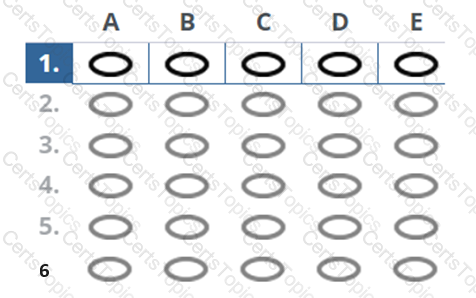

Lines 1 to 6 in the table below consist of an assertion statement and a reason statement. For each line identify the appropriate

option, from options A to E, that applies. Each option can be used once, more than once or not at all.

Which 2 observations correctly evaluate the Income?

Which 2 statements should be recorded under the Proposed charging mechanisms heading?

Which 2 details should be defined when determining spending objectives?

Pittville University insist that the business scope of the Pittville project should be based on the

development of a new campus on the site of the Old Fire Station Headquarters.

Is this an appropriate application of the Five Case Model for this project?

Answer the following question about the Programme Business Case.

The following questions include only true statements, but only 2 statements are

appropriate entries for that heading in the Strategic Case section.

Remember to select 2 answers to each question.

Which 2 statements should be recorded under the Organization overview heading?

The Management Case states that, because the Pittville project is part of the Western Area Learning Improvements Programme:

1. A benefits realization strategy and benefits register are NOT required for the project.

2. All benefits will be tracked at the programme level.

Which 2 statements apply to these entries?

Using the Scenario, answer the following questions about the Financial Appraisal of the option to build a new campus on

the site of the Old Fire Station Headquarters.

Decide whether the action taken represents an appropriate application of the Five Case Model for this project and select the response

that supports your decision.

The cost of the temporary accommodation on the site of the Old Fire Station Headquarters has been treated as a revenue cost within

the Financial Appraisal. This temporary accommodation is required as part of the construction of the new campus.

Is this an appropriate application of the Five Case Model for the project?

Which is an appropriately defined SMART spending objective for greater learner

success rates?

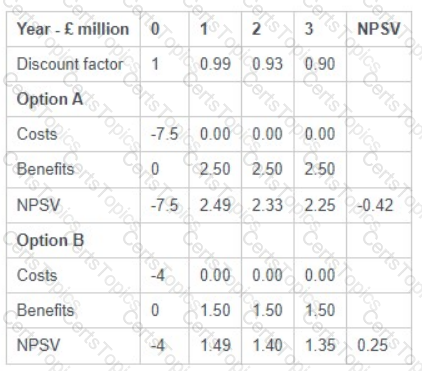

Two of the options in the OBC have been revised, as shown in the table above.

Should Option B be ranked as the preferred option?

Which 2 statements should be recorded under the Potential for risk transfer heading?

Which statement should be recorded under the Benefits Realization heading?

Which statement should be recorded under the Post Project Evaluation heading?

The Benefits Realization Framework section states:

1. It was identified in the OBC that existing schools and universities play a major role in the success or otherwise of the Pittville

project. A strategy for Learning Provider engagement is to be prepared.

2. A senior manager within the Local Education Authority is ultimately responsible for benefits realization.

Which 2 statements apply to these entries?

The Central Government funding programme for the redevelopment of schools has been put on hold. A Review Board will decide

which programmes to continue. This funding programme covers 20% of the Pittville project costs. It is considered very likely that

the Western Area Learning Programme will be high priority due to the forecast enhanced provision of education courses for 16-18

year olds.

Should the funding profile in the Economic Case be updated?

There is a need to meet regulations that address the needs of those with Learning Difficulties and Disabilities

Should this item be recorded as a dependency within the Strategic Outline Case?

Using the Scenario, answer the following questions about scoping the proposal and preparing the Strategic Outline Case for

the Pittville project.

Decide whether the approach is appropriate for stage 1, and select the response that supports your decision.

There is a risk that the local planning authority may reject proposals for development of the Old Fire Station Headquarters site. This

will cause delays to the project.

Should this risk be recorded as an external non-systemic risk within the Strategic Outline Case?

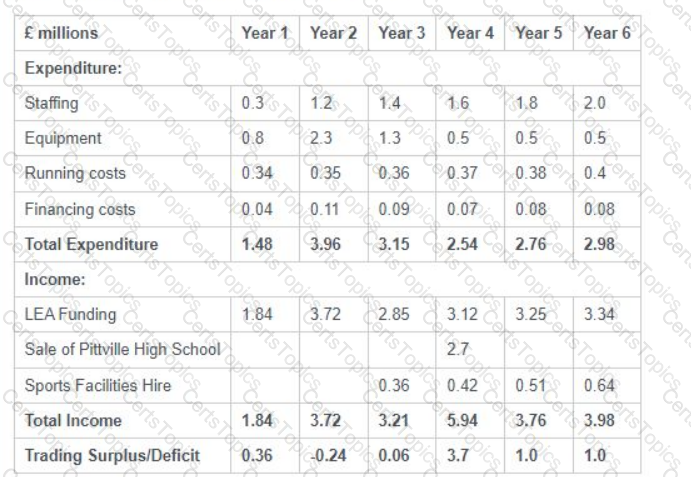

Using the Scenario and the extract below from the Revenue Budget for the Pittville project, answer the following

questions. (Note. The figures entered are correct).

Which 2 observations correctly evaluate the Expenditure?

Which 2 attributes demonstrate that this option supports the key CSF Potential value for money?

Using the Scenario and the information below, answer the following questions about the creation

of the short listed options for the Pittville project.

Spending Objectives

At least 15% increase in rate of participation

A 15% increase in attainment of qualification

At least 65 education courses

Critical Success Factors

Strategic fit and business needs - fit for purpose schools and universities attractive to 16-18-year-old

learners

Potential Value For Money

Supply side capacity and capability

Potential affordability

Potential achievability

Remember to select 2 answers to each question.

Scoping Solution 1: 'Current level of participation, 55 education courses and current qualification

success rate'

Which 2 statements are correct about this entry in the Options Framework?

Using the Scenario, answer the following questions about the Commercial Case for the Pittville project.

The following questions include only true statements about the project, but only two statements are appropriate entries for the

suggested heading of the Commercial Case.

Remember to select 2 answers to each question.

Which 2 statements should be recorded under the Required services heading?

Answer the following questions about the actions taken when preparing the Economic Case within the Full Business Case (FBC).

Decide whether the action taken represents an appropriate application of the Five Case Model for this project and select the response that supports your decision.

Since approval of the OBC, there has been an attractive bid for the Old Fire Station Headquarters site by a supermarket company.

The bid is 15% higher than the original amount that the site was valued at.

Should the FBC production be delayed while the ranking of the options in the OBC is reassessed?