For financial audits, generally accepted auditing standards require that auditors accomplish all of the following tasks EXCEPT

Who is responsible for resolving single audit findings?

The Single Audit Act requires

GPRA requires agencies to prepare and submit a strategic plan, an annual performance plan and

A material weakness in internal control over financial reporting is defined as a deficiency that

When creditworthiness is a criterion for government loan approval, loan applicants must provide

In a performance aygit, due professional care is used to

Which of the following includes the aggregate level and types of risks that the organization is willing to assume in

order to achieve its Strategic objectives?

In relation to financial reporting, who evaluates internal controls to support an opinion on a fair presentation of the financial statements?

Performance measures that relate program inputs to program outcomes are called

Given the information below, which control would be the lowest priority?

Asset$Amount at RiskCost of Control

How may a city parks and recreation director meaningfully assess the performance of the department's grounds maintenance division?

A local government is reviewing the performance of a contractor that is collecting trash for the county. Performance can be measured based upon the cost

An evaluation of anggntity’s single year financial statements would use which of the following analyses?

A state agency has begun a pilot program with a community action agency for a community-based approach to provide services to underserved areas. A review after the first year compared the number of families served by both agencies and identified efficiencies reached by having community involvement. What type of engagement was used to review the pilot program?

A governmental attestation engagement may include a requirement to

A capital asset transferred to another department within the same government should be

According to OMB Circular A-11, what analytical method should be used to measure the cost, schedule and performance goals of a capital asset acquisition project?

To support optimal cash management vendor payment procedures, invoices with discount terms should be paid

A variable that would influence management's decision to hire contractors to perform management control

evaluations is

Which action represents an internal control deficiency in an agency responsible for building and maintaining dams?

The goal of shared gervices is to

An agency benefit program allows employees who commute by public transit up to 10 free taxi trips home per

calendar year. Employees can use the program for personal or family health emergencies. The most appropriate

method to check for abuse of this program is

Simplified acquisition processes assist an agency by

The National Performance Management Advisory Commission established a comprehensive framework that

incorporates performance measurement into the

If a CGFM wants to utilize data on population growth, housing and employment to estimate sales tax revenue, the CGFM should use

Which of the following acts requires federal agencies to pay interest to state government funds for entitlements that

are not provided in a timely manner?

A city parks department is selecting a contractor to renovate a community playground. Which of the following contractors should be selected?

Auditors may limit their public reporting in attestation engagements when the

If a state treasurer wants to evaluate a variety of alternative long-term investments, which financial analysis should

be used?

An analyst has identified several variables that may be impacting state lottery ticket sales, including investments in

advertising, potential pay-out amounts and the size of lottery cards. Which of the following techniques would help

determine the extent to which each variable is impacting sales?

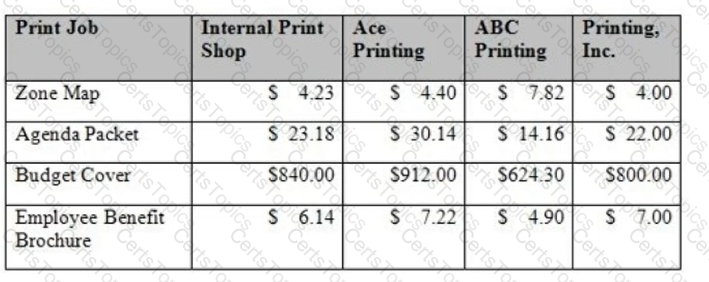

Based on the data below, what can be concluded about outsourcing print job?

Internal control over financial reporting means that management can reasonably make which of the following assertions?

In addition to the Yellow Book, which group's external audit standards can the GAO reference?