Verified By IT Certified Experts

CertsTopics.com Certified Safe Files

Up-To-Date Exam Study Material

99.5% High Success Pass Rate

100% Accurate Answers

Instant Downloads

Exam Questions And Answers PDF

Try Demo Before You Buy

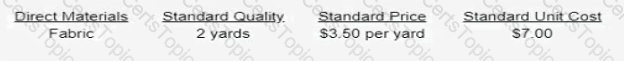

Huaxia Manufacturing's standard cost card for product GH1 includes the following:

During the month of June, Huaxia produced 12,300 units. The purchasing department purchased 30,400 yards of fabric for a total cost of $100,320. The production department used 25.300 yards of fabric in June. What is Huaxia's direct materials price variance for the month of June?

Which of the following represents a significant deficiency m the design of controls?

Identify one external factor that provides opportunity for the Food-To-Go division.

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting. Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division’s budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

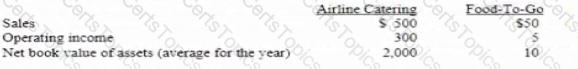

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).