Known limitations of VaR methodology include the fact that changes in market may not tend to normal distribution (specifically, that very large movements are more likely than predicated by the normal distribution assumption); BECAUSE:

The federal open market committee (FOMC) board sets reserve requirements and shares the responsibility with the reserve banks for:

Universal life policies are a form of permanent life insurance that has flexible premiums, flexible face amounts, and separate pricing for the three major pricing categories. Which of the following is/are out of those categories?

The risks associated with operating objectives include all of the following EXCEPT:

An area of FOMC board responsibilities is the development and administration of regulation that implement major federal laws governing consumer credit, such as:

“A negotiated offering in which a new issue of municipal securities is sold on an agency basis by a placement agent directly to institutional or private investors rather than through an offering to the general investing public” is referred as:

Purchasers of universal life policies specify the policy’s face amount and whether the death benefit will be level or vary as the policy’s cash value changes. Under level death benefit policies the death benefit payable:

Basel II aims to improve the security and long-term viability of the financial system by focusing on bank’s ____________

_____________ insures two lives under one policy. Death benefits are paid to the surviving insured. The surviving insured usually has the option of purchasing an individual whole life policy of the same face amount without providing evidence of insurability.

Insurance products yield _________ compared to regular investment option and this is besides the added incentives (read bonuses) offered by insurers.

Which one of the following is common misinterpretation during the calculation of VaR

It is a characteristic of insurance policy according to which the insured decides whether or not to pay the premium to be covered by the policy. If the insured pays the premium, the insurance coma pay is obliged to make payments as stated in the policy. What is it?

When a bank charges off a loan as a loss, it reduces an account called the”_____________”

IF a securitization transaction meets FAS 125 sale or servicing criteria, the seller must recognize any gain or loss on the sale of the pool immediately and carry any retained interests in the assets sold ( including servicing rights/obligation and interest-only strips) at ____________.

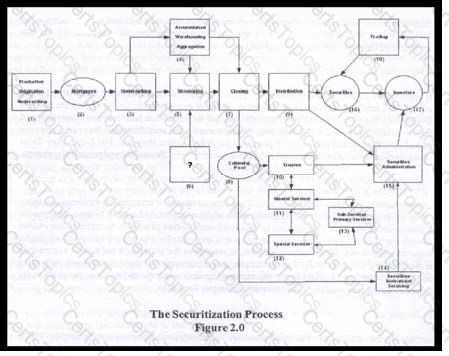

Which of the following should be the next step after the structuring process in order to complete the securitization process?

Insurance policies are good for insurance needs, however, as a main investment vehicles, they have considerable downsides.

Risks inherent in the management process are known as:

Compliance testing is designed primarily to:

Watch lists of loans that are in danger of becoming delinquent generally contain information on such as:

An organization might decide that the risk of fire is high so it will pay a high premium on its fire insurance policy to transfer the risk as much as possible. However, the organization will still have to pay deductible amount on the policy if a fire occurs. This scenario depicts:

“Ongoing monitoring activities are conducted to periodically reassess risk and the effectiveness of control risk,” is an objective of:

The responsibility for preparing and presenting the audited financial statements is that of:

During the posting process of ledger records on deposit account banks may reject some transactions because:

Which one of the following activities is not related to the trust committee activities that should be reviewed?

Some wills specify that more than one responsible party share the trustee’s responsibilities of an estate .The condition depicts relation with which one of the following trust services:

Data gathering and evaluation during field work includes:

If principal is paid on a loan after it has been placed on non-accrual status, the bank must determine whether it should record the payment as a reduction of:

Which one of the following audit objectives and steps should not be considered when performing an audit of deposit account?

Demand deposit account allows customers to transfer money through the use of:

Following elements should be documented in the audit scope EXCEPT:

The scope of an audit defines the boundaries of the audit by addressing such items as the audit period or number of locations to be reviewed.. Some important considerations when defining the scope of an audit include:

Internal auditors, engaging in activities that are illegal and discreditable to the profession of internal auditing or the organization, violate which of the following principles:

Which one of the annuities, mentioned below, is not regulated by the SEC:

Some organizations have information protection policies that place the burden of information protection on managers in individual organizational units. An information protection policy may include:

Due from bank balances are used to:

___________ are investment securities that do not fall under one of the other types of securities. Examples of these are Type III securities including corporate bonds and municipal bonds.

Municipal bonds are issued by state and local governments, U.S. territories, and non-federal public agencies such as school districts, cities, and airport authorities. Municipal debt is considered the second safest form of debt security after U.S. government obligations. Some types of municipal bonds include all of the following EXCEPT:

Unsecured bonds are not backed by assets and provide no claim on assets for bondholders These include:

Non-deposit investment product includes:

Elements of information and process integrity are that it should be authorized, accurate, complete, timely, recorded processed, and reported in the proper time. Each of the elements in the above has a relationship to the:

Most municipal and corporate bonds are rated by an independent rating firm such as Standard & Poor’s (S&P) or Moody’s. These ratings provide investors with information regarding the risk of default on the bond issue. The higher rated bonds are considered _________.

When conducting an audit of securities investments, the following objectives and audit steps should be considered EXCEPT:

Most corporations have an annual meeting where stockholders have the opportunity to vote on important issues. These issues include:

Banks generally record securities transactions as of trade date. However, it is acceptable to record the transactions as of the _________ if the difference between the settlement date and trade date is not materially different.

It is a contract that defines corporation and bondholders responsibilities and is designed to protect the right of the bondholders. A trustee (most often a commercial bank) is generally appointed to ensure that the obligations defined in the agreement are of trust indenture must e filled with SEC. What is it?

Options are quoted daily in the newspapers. The listing provides the name of the underlying stock and its closing price that day, the strike price of the option, the closing prices(premiums) of the 3 call and 3 put contracts trading closest to expiration. Listings can be divided into categories. Which of the following is/are out of those categories?

The reliability (competence) of evidence gathered by auditors is a __________. The reliability of evidence is a key factor in the audit analysis. Relevance is also a key factor in determining the quality of evidence.

Derivates can be effective low cost tools for managing expose experience losses due to:

There are different classes of mutual funds. Classes that typically do not have a front-end sales load. Instead they may impose a contingent deferred sales load and a 12b-1 fee (along with other annual expenses) is called:

Which of the following is not an audit objective of a commodity department?

Which of the following is least expensive form of life coverage, at least initially?

In which of the following ways would the writer of an uncovered call usually make a profit?

I. The call expires

II. The underlying stock splits

III. The underlying stock goes up in price

IV. The underlying Stock goes down in price

The administration of personal trust accounts is primarily controlled by all of the following EXCEPT:

Cash surrender life insurance is referred to:

The duties of a guardian in guardianship arrangements are similar to those of a trustee.

Specifically, the guardian is obligated to:

1) Protect and preserve the assets

2) Submit an inventory and appraisal to the court

3) Retain or divest assets

4) Use principal and income for the benefit of the ward

5) Submit an annual accounting to the court

Major types of individual long-term disability policies are all EXCEPT:

The responsibility of setting an estate includes:

Call provisions are often part of ______________, but usually not bonds issued by ______________.

Occasionally, a company will issue additional shares of its stocks, called ____________, to raise additional capital.

I- With reference to the granting of customer credit lines a thorough analysis of the customer’s overall financial position is performed prior to trading authorization.

II-confirmations of each transaction are sent to customers indicating the quantity, delivery month and the contract price to ensure the integrity of transactions.

III-Original margin deposits in cash or acceptable securities to guarantee performance of contracts are determined in accordance These all are adequate procedures and controls associated with:

One fund may invest on mostly established “blue chip” (Companies that pay regular dividends). Another fund may invest in newer technology companies that pay no dividends but that may have more potential for growth. These are the examples of:

Money market funds bond funds (also called “fixed income” funds) , and stock funds (also called equity funds) are the categories of:

A UIT typically issues redeemable securities (or “units”), like a mutual fund, which means:

____________ swaps give companies extra flexibility to exploit their comparative advantage in their respective borrowing markets.

Some specific requirements of securities and exchange 1934 Act are:

Correspondent banks, Credit party, Draw down, Execution date, Remitter, and Repetitive transfer are some terminologies related to:

Letters of credit are also known as:

__________ allows businesses that sell durable goods such as automobiles to finance inventories. As the business sells goods, the loan advance against those goods is repaid.

The term “thrift institution” is referred to:

Preliminary prospectuses are often called:

Life insurance includes all of following the products EXCEPT:

Policy holders of whole life insurance use the cash dividends in many ways as:

Commercial banks create money by:

Which one of the following is an additional duty of trust department?

Asset/Liability (ALM) is a short and long term planning tool designed to maximize earnings. ALM tries to create optimal risk/reward decisions and focuses on creating prices that achieve spread. A sound ALM policy must manage following types of risks EXCEPT:

Securities available for resale, by the bank, should be reported at: