Calculate QDDs financial leverage ratio show your calculations

Essay

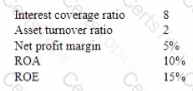

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Assuming mere are no other imitations, should AMI accept the one-time order from a financial perspective? Explain your answer

Essay

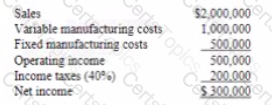

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.