You are utilizing the “Upload Customer From Spreadsheet” option. What information on the Customer Worksheet must be unique for each customer record?

Which flexfields are required to be used by auto invoice to identify transactions and transaction lines, if you load the interface using a customized form?

Whenusing lockbox to process customer payments, which two tables are used in the upload? (Choose two.)

A Billing Specialist runs the Create Automatic Billing Adjustments program to automatically adjust the remaining balance on openinvoices, but some of the amounts have exceeded the Billing Specialist's approval limits.

What would be the result?

You are the Billing Manager and you are responsible for reviewing adjustments and approving them.

Which two tabs are available in the Adjustments Overview Region on the Billing Work Area page? (Choose two.)

Which three receipts can be automatically applied by a system? (Choose three.)

A Cloud client has a requirement to process the most precise revenue recognition schedule.

Which revenue schedule would you use to achieve this requirement?

You are investigating the Receivables to General Ledger Reconciliation Report and must explain any variances to your Accounting Manager.

What two variance amounts should you expect to investigate in this report? (Choose two.)

Your customer wants to override the calculated tax line amount for their receivable transaction.

What steps should the customer perform to ensure that only one of their employees has this privilege?

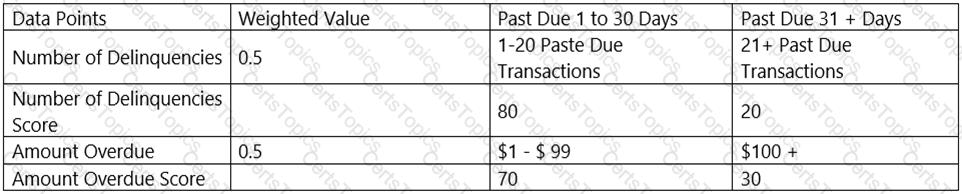

As a consultant, you have builtthe following Scoring model in Advanced Collections:

If a customer has 10 past due transactions and an amount overdue of $125, what is the calculated score?

You schedule print runs of transactionsand balance forward bills according to the needs of your enterprise.

Which three statements are true? (Choose three.)

Which setup is required to ensure that the same tax is applied on both intercompany payable and intercompany receivable invoices?

What validation step is required for implementing dispute processing?

The Billing Manager has navigated to the Billing work area to complete a transaction. The Incomplete Transactions Overview Region on the Billing Work Area page has a drilldown option through a column to complete the transaction.

Identifythe column.

Which three interest rate calculation formula methods are supported in Receivables? (Choose three.)

Which configuration step is required for processing Collections disputes?

When running the delinquency process for a customer, the business unit for which you want to run theprocess does not appear in the drop-down menu.

Identify the action that you need to take.

What are the three seeded contract configuration rules that Revenue Management provides to automatically create contracts? (Choose three.)

Identify two values that default from Customer Profile Classes. (Choose two.)

What are the three setup steps required to implement the Lockbox feature? (Choose three.)

You have been challenged by the Implementation team to configure AutoAccounting for the Revenue Account Type.

From which three tables can the segment value be defaulted? (Choose three.)

What are three functions of the Create AutomaticReceipt Write-offs program? (Choose three.)