Ellen and her only son Jeff live on the family farm with her father George. Jeff is five years old and Ellen has decided that it is time to start saving for Jeff’s post-secondary education. She has called you to ask about registered education savings plans (RESPs).

Which of the following statements is TRUE?

Your clients, Philip and Helen, have a disabled son, Alex, age 22. They want to set up a registered disability savings plan (RDSP) for Alex and have asked you for some information.

Which statement is TRUE?

Based on your discussions with your client Sierra, you believe an asset allocation of 30% fixed income and 70% equities will help her achieve her long-term goals. What type of asset allocation strategy are you implementing?

Throughout the year, the Redwood Global Equity Fund generated the following outcomes:

. $1.00 per unit of interest income from Canadian treasury bills

. $2.50 per unit of dividend income from foreign corporations

. $7.75 per unit of capital gains from the sale of Canadian corporations

. $6.50 per unit of capital gains from the sale of foreign corporations

. $2.00 per unit of capital losses from the sale of foreign corporations

Given that the Redwood Global Equity Fund is structured as a mutual fund trust, which of the following statements is true?

One of your clients, Fernando, is approaching 71 years of age and has a few questions regarding life income funds (LIFs).

Which of the following statements about LIFs is TRUE?

Which information is typically included in the Letter of Engagement?

Russell is a Dealing Representative with Wealth Quest Strategies Ltd., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Russell is developing his website to

include sales content on a Target Date Fund. Which of the following is Russell permitted to include on his website about the Target Date Fund?

i. the asset mix through the life of the fund until the future date

ii. the expected decline in the fund's risk level as the fund reaches its target date

iii. the guaranteed return that the client will receive on the future date

iv. a graphic illustration of the fund's promised growth on target date

Which of the following characteristics about mortgage mutual funds is CORRECT?

Faruq is a Dealing Representative with Smart Planning Group, a mutual fund dealer. Faruq meets with his new client, Taline, and learns that she lives on a low, fixed income.

Taline tells Faruq that she wants to maximize her investment returns as high as possible to make up the difference. Taline also indicates that she cannot afford large investment losses because her income is low. Which of the following CORRECTLY describes how Faruq should assess Taline’s risk profile?

As a measurement of risk, which of the following statements about beta is TRUE?

Your client, Rinaldo, wants to know more about the fees associated with his mutual funds. What can you tell him about a mutual fund’s management expense ratio (MER)?

Yesterday, Mariana who is new to investing and purchased mutual funds for the very first time. She shared her excitement with her good friend, Julius. However, after Julius learned about her investment, he

admits that he had a bad experience with mutual fund investing and that he lost money. Mariana regrets not talking to Julius prior to making her decision. Her feelings of enthusiasm have changed to fear. She

is wondering if it is too late to change her mind and cancel her purchase order.

Which statement regarding the right of withdrawal is CORRECT?

What does a normal yield curve look like?

Darryl has a diversified investment portfolio of mutual funds in a non-registered account with Investwell Mutual Funds, a mutual fund dealer. Darryl’s diversified portfolio is composed of 3 mutual funds. Each mutual fund is currently worth about $100,000. The ABC Canadian Equity Fund has a total return of 6%, the DEF Bond Fund has a total return of 8% and GHI Global Equity Fund has a total return of 10%. Darryl wants to make an in-kind contribution to his registered retirement savings plan (RRSP) account. He has unused RRSP contribution room of $60,000.

From a tax-efficient viewpoint, which funds contribute in-kind to his RRSP account?

Which of the following is a conflict of interest that should be AVOIDED?

Which of the following statements about capital gains distributions from mutual fund trusts is correct?

Which of the following statements best describes dollar-cost averaging?

Sujay contributes 3% of his $60,000 salary to his employer’s defined contribution pension plan. His employer contributes the same amount to the plan. How will this affect his registered retirement savings plan (RRSP) contribution room for the year?

Patrick is a portfolio manager for the HyperTally Growth Fund. It has generated an annualized rate of return of 10% this past year. However, with the anticipation of very high inflation to soon occur, there is also an expectation of higher interest rates. Patrick is concerned about the future returns of existing stocks within the fund. What may Patrick do to protect against the market value of the fund dropping?

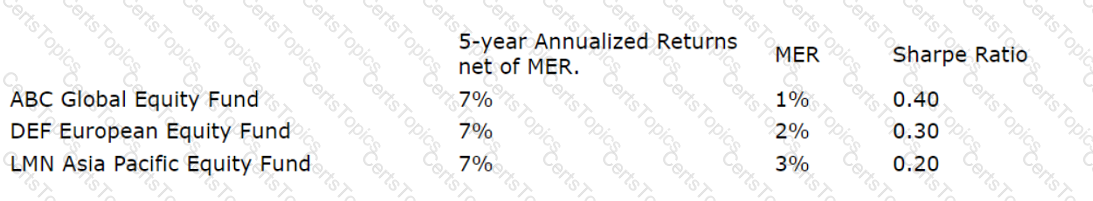

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

What role do investment dealers play in the Canadian and global financial markets?

In a mutual fund dealer, who is the person responsible for establishing and maintaining compliance policies and procedures as well as monitoring and assessing compliance?

One of your clients, Harry, has heard that he can defer paying tax on capital gains. He wants to know if what he has heard is correct and if so, how to defer paying taxes on capital gains.

What would you tell Harry?

What statement CORRECTLY describes a key difference between bonds and debentures?

Gregory is a conservative investor who wants to hold a portfolio of equity securities that would fall less than the overall market in a downturn.

Which of the following portfolios would you advise Gregory to invest in?

Catarina is a Dealing Representative for Ethical Financial which represents 20 different mutual fund families. Darlene is a fund manager from one of those mutual fund families and wants to send a gift card to Catarina as a symbol of appreciation. Ethical Financial's policies and procedures manual (PPM) require that Catarina decline the gift.

What method of addressing conflict of interest is being used by Ethical Financial?

Your client, Cosmo, recently inherited $50,000 from his uncle. He wants to use this money towards his retirement savings. Cosmo is a 50-year old, self-employed carpenter and he earns on average $65,000

per year. He has a registered retirement savings plan (RRSP) with the bank worth $425,000 and a tax-free savings account (TFSA) worth $46,000. He started saving when he was 25 years old and has always

made his own investment decisions. His money is mostly invested in balanced funds. He feels most comfortable with these types of mutual funds since they offer potential investment growth but without being too aggressive. Cosmo has no other assets.

What additional information do you need about Cosmo to fulfill your know your client obligation?

Megan purchases a treasury bill for $98,200. When it matures for $100,000, how does Megan treat the $1,800 difference?

Sonya meets with her client Elijah to review different investment approaches that could be offered to help him reach his financial goals. Part of that discussion included Sonya mentioning factors such as

inflation, interest rates, and rates of return. Which stage of the Strategic Investment Planning (SIP) process does this describe?

Louis is the portfolio manager for Quattro Fund. The mandate of the mutual fund is to invest in a combination of cash, fixed income, and equity securities; however, Louis has the ability to adjust the portfolio according to market conditions. If Louis feels that interest rates will fall, he could invest the whole portfolio in equities. If he feels the market is too high, he could take profits and sit totally in cash. What type of mutual fund is Quattro Fund?

Lucas wants to participate in the Lifelong Learning Program (LLP). He currently has $10,000 in his registered retirement savings plan (RRSP) for this purpose. He plans to make his maximum permitted

withdrawal of $10,000 under the LLP in two months. Based on this information, what would be his investment objective for the $10,000 currently sitting in his RRSP?

Sven owns preferred shares that give him the option to sell his holdings back to the issuing company at a predetermined price and within a specified time. What type of preferred shares does Sven own?

Karen’s know your client (KYC) profile corresponds to someone who has a long time horizon, is comfortable with risk and volatility, and is primarily interested in growth. She watches the daily movements of the Toronto Stock Exchange (TSX) and wants a mutual fund that will closely match what she sees.

What kind of mutual fund would be BEST for her?

What type of shares offer its shareholders the opportunity to receive additional dividends if the company’s profit exceeds a stated level?

Lior is considering an investment that gains exposure to companies that trade on the Toronto Stock Exchange (TSX). He is not sure what the differences are between a Canadian equity fund and a Canadian dividend fund.

What would you tell him?

Pippa purchased a 15-year bond with a face value of $5,000 and a 7% coupon rate at the time of issuance. The bond is due to mature later this year. The general interest rate climate remained stable for the first 13 years of the bond's term. However, especially over the past 18 months, both inflation and general interest rates have increased more than expected.

What is Pippa likely to experience from her bond?

Which of the following is included when calculating a country's gross domestic product (GDP)?

Danica is looking for a mutual fund to hold in her non-registered account that provides a regular stream of income with potential for capital growth. She is having difficulty distinguishing between bond funds and dividend funds. Which of the following statements is TRUE?

Greg, one of your clients, has been advised by a friend to invest in open-end mutual funds. He is not sure about the differences between open and closed-end funds.

What would you tell Greg about open-end funds?

Which of the following best describes how a target date fund works?

Nelson is a Dealing Representative with True Wealth Advisors Inc., a mutual fund dealer. Nelson follows proper procedures related to his firm’s Relationship Disclosure Information (RDI). Which of the following CORRECTLY describes how Nelson is permitted to evidence that he satisfied his RDI obligation?

The Mutual Fund Dealers Association of Canada (MFDA) has strict rules concerning conflicts of interest. Which of the following is TRUE?

Charlotte has received proceeds from a deceased family member’s estate. Charlotte decides to visit Malik, who’s a Dealing Representative at her bank. She tells Malik, she does not know much about trading ETFs, but she wants to invest in ETFs. Charlotte says she feels fortunate to have this money and that she’s not worried about losing it because she never planned on having any of it.

What element of the Know Your Client (KYC) information has Malik been able to learn?

Which of the following Dealing Representatives has fulfilled their "Know Your Product" obligation?

Maxine is a portfolio manager who 15 years ago, purchased 100 shares of Never2Tacky, a social media corporation for Aspirations Global Technology Fund. She purchased the stock when it was trading at $10. Last year, the peak market price was $120. Presently, it is trading at $99. News agencies are now reporting that additional regulations regarding social media companies are about to be agreed upon by G7 countries. Maxine is concerned the market value of Never2Tacky is going to drop. She buys a put option with an exercise price of $95 with an expiry of 9 months.

What type of strategy is Maxine using?

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC) indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

Which of the following actions by the federal government or the Bank of Canada is an example of monetary policy?

Daisy is a Dealing Representative registered in the province of Saskatchewan only. Daisy’s client, Orville, a resident of Lloydminster, Saskatchewan is a retiree who presently has a $1,000,000 with her dealer, Easy Ride Financial. Orville is now planning to move to Vegreville, Alberta next month. Easy Ride Financial is registered in Alberta and Saskatchewan. Neither Easy Ride Financial nor Daisy have any clients who are resident in Alberta.

Which of the following should Daisy do if she wants to continue to service Orville’s account?

Your client, Helen, just received her non-registered account statement which states that one of her mutual funds made an interest income distribution during the year. She asks you how she will be taxed on the distribution. What do you tell Helen?

Saheed is a retiree who is considering splitting his pension income with his wife, Minu.

Which of the following outcomes may occur if he shares his pension benefits?

Malik has been saving money for retirement but he is worried about the impact inflation may have on the value of his savings. He wants to purchase a bond that will give him a steady stream of income that is greater than the inflation rate. He has found a bond issued by a major airline with a market price of $9,200, a par value of $10,000, and a coupon rate of 6.75%. What is the current yield of this bond?

Which of the following applies to a mutual fund trust?