Outline three methods an organization could use to gain feedback from stakeholders (25 points)

See the answer in Explanation below:

Gaining feedback from stakeholders helps organizations understand their needs and improve performance. Below are three methods, detailed step-by-step:

Surveys and Questionnaires

Step 1: Design the ToolCreate structured questions (e.g., Likert scales, open-ended) tailored to stakeholder groups like customers or suppliers.

Step 2: DistributionDistribute via email, online platforms, or in-person to ensure accessibility.

Step 3: AnalysisCollect and analyze responses to identify trends or issues (e.g., supplier satisfaction with payment terms).

Outcome:Provides quantitative and qualitative insights efficiently.

Focus Groups

Step 1: Organize the SessionInvite a small, diverse group of stakeholders (e.g., employees, clients) for a facilitated discussion.

Step 2: Conduct the DiscussionUse open-ended questions to explore perceptions (e.g., “How can we improve delivery times?”).

Step 3: Record and InterpretSummarize findings to capture detailed, nuanced feedback.

Outcome:Offers in-depth understanding of stakeholder views.

One-on-One Interviews

Step 1: Select ParticipantsChoose key stakeholders (e.g., major suppliers, senior staff) for personalized engagement.

Step 2: Conduct InterviewsAsk targeted questions in a private setting to encourage candid responses.

Step 3: Synthesize FeedbackCompile insights to address specific concerns or opportunities.

Outcome:Builds trust and gathers detailed, individual perspectives.

Exact Extract Explanation:

The CIPS L5M4 Study Guide highlights stakeholder feedback methods:

Surveys:"Surveys provide a scalable way to gather structured feedback from diverse stakeholders" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Focus Groups:"Focus groups enable qualitative exploration of stakeholder opinions" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Interviews:"One-on-one interviews offer detailed, personal insights, fostering stronger relationships" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).These methods enhance stakeholder engagement in procurement and financial decisions. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.

Describe three ways in which an organization can encourage a healthy short-term cash flow by engaging in the effective management of debtors and credit management (25 points)

See the answer in Explanation below:

Effective management of debtors and credit is crucial for maintaining a healthy short-term cash flow. Below are three key ways an organization can achieve this, explained step-by-step:

Implementing Strict Credit Control Policies

Step 1: Assess CreditworthinessBefore extending credit, evaluate customers’ financial stability using credit checks or references.

Step 2: Set Credit Limits and TermsDefine clear credit limits and payment deadlines (e.g., 30 days) to avoid overextension of credit.

Step 3: Monitor ComplianceRegularly review debtor accounts to ensure timely payments, reducing the risk of bad debts.

Impact on Cash Flow:This ensures cash inflows are predictable and minimizes delays, improving liquidity.

Offering Early Payment Incentives

Step 1: Design DiscountsProvide discounts (e.g., 2% off if paid within 10 days) to encourage debtors to settle invoices early.

Step 2: Communicate TermsClearly state discount terms on invoices and contracts to prompt action.

Step 3: Track UptakeMonitor which debtors take advantage of discounts to refine the strategy.

Impact on Cash Flow:Accelerates cash inflows, reducing the cash conversion cycle and boosting short-term funds.

Pursuing Proactive Debt Collection

Step 1: Establish a ProcessSet up a systematic approach for following up on overdue payments (e.g., reminder letters, calls).

Step 2: Escalate When NecessaryUse debt collection agencies or legal action for persistent non-payers.

Step 3: Analyze PatternsIdentify habitual late payers and adjust credit terms accordingly.

Impact on Cash Flow:Recovers outstanding funds quickly, preventing cash flow bottlenecks.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide underscores the importance of debtor and credit management for cash flow optimization. Specifically:

Credit Control Policies:The guide states, "Effective credit management involves assessing customer creditworthiness and setting appropriate terms to ensure timely cash inflows" (CIPS L5M4 Study Guide, Chapter 3, Section 3.2). This reduces the risk of cash shortages.

Early Payment Incentives:It notes, "Offering discounts for early payment can significantly improve short-term liquidity" (CIPS L5M4 Study Guide, Chapter 3, Section 3.3), highlighting its role in speeding up cash collection.

Debt Collection:The guide advises, "Proactive debt recovery processes are essential to minimize bad debts and maintain cash flow" (CIPS L5M4 Study Guide, Chapter 3, Section 3.4), emphasizing structured follow-ups.These strategies align with the broader objective of financial stability in procurement and contract management. References: CIPS L5M4 Study Guide, Chapter 3: Financial Management Techniques.

John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

See the answer in Explanation below:

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

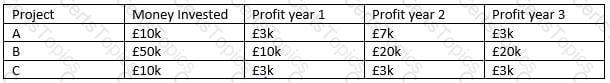

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessingthe financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

Definition:

A math equation with numbers and a square

AI-generated content may be incorrect.

A math equation with numbers and a square

AI-generated content may be incorrect.

Net Profit = Total Returns – Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing £100k that generates £120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4’s emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

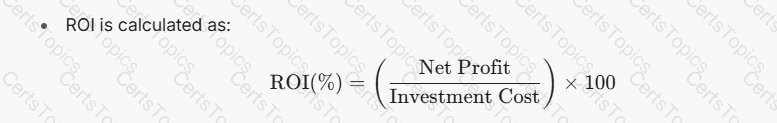

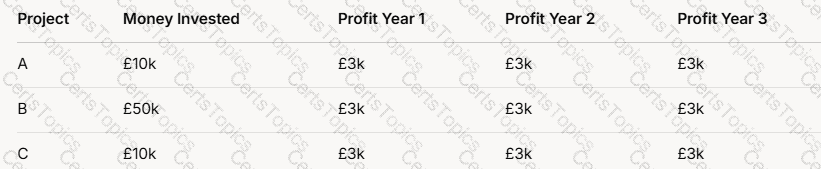

Using the data provided for the three projects, let’s calculate the ROI for each to determine the best option for John. The table is as follows:

A screenshot of a phone

AI-generated content may be incorrect.

A screenshot of a phone

AI-generated content may be incorrect.

Step 1: Calculate Total Profit for Each Project:

Project A: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project B: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project C: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Step 2: Calculate Net Profit (Total Profit – Investment):

Project A: £9k – £10k = -£1k (a loss)

Project B: £9k – £50k = -£41k (a loss)

Project C: £9k – £10k = -£1k (a loss)

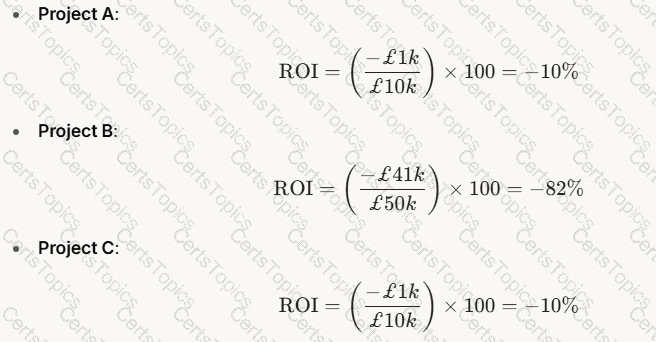

Step 3: Calculate ROI for Each Project:

A group of math equations

AI-generated content may be incorrect.

A group of math equations

AI-generated content may be incorrect.

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROIAll projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (£10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose eitherProject A or Project Cover Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let’s recommendProject A.

Recommendation: John should chooseProject A(or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as "a measure of the gain or loss generated on an investment relative to the amount invested," typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing "value for money," a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a "clear financial snapshot" of investment performance. In John’s case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI’s role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI’s "ease of calculation" makes it accessible for quick assessments, ideal for John’s scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI’s alignment with "maximizing returns," ensuring investments like John’s projects deliver financial value.

Comparability:

ROI’s percentage format allows "cross-project comparisons," per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI "does not consider the timing of cash flows," a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss "strategic benefits" like quality or innovation, which might apply to John’s projects.

Potential for Misleading Results:

The guide cautions that ROI can be "distorted" if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide’s focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to "rank investment options" but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide’s emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.

Discuss four factors which may influence supply and demand in foreign exchange (25 points)

See the answer in Explanation below:

The supply and demand for foreign exchange (FX) determine currency exchange rates, influenced by various economic and external factors. Below are four key factors, explained step-by-step:

Interest Rates

Step 1: Understand the MechanismHigher interest rates in a country attract foreign investors seeking better returns, increasing demand for that currency.

Step 2: ImpactFor example, if the UK raises rates, demand for GBP rises as investors buy GBP to invest in UK assets, while supply of other currencies increases.

Step 3: OutcomeStrengthens the currency with higher rates, shifting FX equilibrium.

Inflation Rates

Step 1: Understand the MechanismLower inflation preserves a currency’s purchasing power, boosting demand, while high inflation increases supply as holders sell off.

Step 2: ImpactA country with low inflation (e.g., Japan) sees higher demand for its yen compared to a high-inflation country.

Step 3: OutcomeLow inflation strengthens a currency; high inflation weakens it.

Trade Balance

Step 1: Understand the MechanismA trade surplus (exports > imports) increases demand for a country’s currency as foreign buyers convert their money to pay exporters.

Step 2: ImpactA US trade surplus increases USD demand; a deficit increases USD supply as imports require foreign currency.

Step 3: OutcomeSurplus strengthens, deficit weakens the currency.

Political Stability

Step 1: Understand the MechanismStable governments attract foreign investment, increasing currency demand; instability prompts capital flight, raising supply.

Step 2: ImpactPolitical unrest in a country (e.g., election uncertainty) may lead to selling its currency, reducing demand.

Step 3: OutcomeStability bolsters, instability depresses currency value.

Exact Extract Explanation:

The CIPS L5M4 Study Guide outlines these factors as critical to FX markets:

Interest Rates:"Higher rates increase demand for a currency by attracting capital inflows" (CIPS L5M4 Study Guide, Chapter 5, Section 5.5).

Inflation Rates:"Relative inflation impacts currency value, with lower rates enhancing demand" (CIPS L5M4 Study Guide, Chapter 5, Section 5.5).

Trade Balance:"A positive trade balance boosts currency demand; deficits increase supply" (CIPS L5M4 Study Guide, Chapter 5, Section 5.5).

Political Stability:"Stability encourages investment, while uncertainty drives currency sell-offs" (CIPS L5M4 Study Guide, Chapter 5, Section 5.5).These factors are essential for procurement professionals managing international contracts. References: CIPS L5M4 Study Guide, Chapter 5: Managing Foreign Exchange Risks.===========

What tools are available for buyers to help procure items on the commodities market? (25 points)

See the answer in Explanation below:

Buyers in the commodities market can use various tools to manage procurement effectively, mitigating risks like price volatility. Below are three tools, detailed step-by-step:

Futures Contracts

Step 1: Understand the ToolAgreements to buy/sell a commodity at a set price on a future date, traded on exchanges.

Step 2: ApplicationA buyer locks in a price for copper delivery in 6 months, hedging against price rises.

Step 3: BenefitsProvides cost certainty and protection from volatility.

Use for Buyers:Ensures predictable budgeting for raw materials.

Options Contracts

Step 1: Understand the ToolGives the right (not obligation) to buy/sell a commodity at a fixed price before a deadline.

Step 2: ApplicationA buyer purchases an option to buy oil at $70/barrel, exercising it if prices exceed this.

Step 3: BenefitsLimits downside risk while allowing gains from favorable price drops.

Use for Buyers:Offers flexibility in volatile markets.

Commodity Price Indices

Step 1: Understand the ToolBenchmarks tracking average commodity prices (e.g., CRB Index, S&P GSCI).

Step 2: ApplicationBuyers monitor indices to time purchases or negotiate contracts based on trends.

Step 3: BenefitsEnhances market intelligence for strategic buying decisions.

Use for Buyers:Helps optimize procurement timing and pricing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details these tools for commodity procurement:

Futures Contracts:"Futures allow buyers to hedge against price increases, securing supply at a known cost" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

Options Contracts:"Options provide flexibility, protecting against adverse price movements while retaining upside potential" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

Price Indices:"Indices offer real-time data, aiding buyers in timing purchases and benchmarking costs" (CIPS L5M4 Study Guide, Chapter 6, Section 6.4).These tools are critical for managing commodity market risks. References: CIPS L5M4 Study Guide, Chapter 6: Commodity Markets and Procurement.===========

Organizational strategies can be formed at three different levels within a business. Outline these three levels and explain the benefits of strategy alignment within an organization (25 points)

See the answer in Explanation below:

Part 1: Outline of the Three Levels of StrategyOrganizational strategies are developed at three distinct levels, each with a specific focus:

Corporate Level Strategy

Step 1: Define the LevelFocuses on the overall direction and scope of the organization (e.g., what businesses to operate in).

Step 2: ExamplesDecisions like diversification, mergers, or market expansion.

Outcome:Sets the long-term vision and portfolio of the business.

Business Level Strategy

Step 1: Define the LevelConcentrates on how to compete in specific markets or industries (e.g., cost leadership, differentiation).

Step 2: ExamplesPricing strategies or product innovation to gain market share.

Outcome:Defines competitive positioning within a business unit.

Functional Level Strategy

Step 1: Define the LevelFocuses on operational execution within departments (e.g., procurement, HR, marketing).

Step 2: ExamplesOptimizing supply chain processes or improving staff training.

Outcome:Supports higher-level goals through tactical actions.

Part 2: Benefits of Strategy Alignment

Step 1: Unified DirectionEnsures all levels work toward common goals, reducing conflicts (e.g., procurement aligns with corporate growth plans).

Step 2: Resource EfficiencyAllocates resources effectively by prioritizing aligned objectives over siloed efforts.

Step 3: Enhanced PerformanceImproves outcomes as coordinated strategies amplify impact (e.g., cost savings at functional level support business competitiveness).

Outcome:Creates a cohesive, high-performing organization.

Exact Extract Explanation:

The CIPS L5M4 Study Guide addresses strategic levels and alignment:

Three Levels:"Corporate strategy defines the organization’s scope, business strategy focuses on competition, and functional strategy supports through operational excellence" (CIPS L5M4 Study Guide, Chapter 1, Section 1.5).

Alignment Benefits:"Strategy alignment ensures consistency, optimizes resource use, and enhances overall performance" (CIPS L5M4 Study Guide, Chapter 1, Section 1.6).This is critical for procurement to align with organizational objectives. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.

Peter is looking to put together a contract for the construction of a new house. Describe 3 different pricing mechanisms he could use and the advantages and disadvantages of each. (25 marks)

See the answer in Explanation below:

Pricing mechanisms in contracts define how payments are structured between the buyer (Peter) and the contractor for the construction of the new house. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, selecting an appropriate pricing mechanism is crucial for managing costs, allocating risks, and ensuring value for money in construction contracts. Below are three pricing mechanisms Peter could use, along with their advantages and disadvantages, explained in detail:

Fixed Price (Lump Sum) Contract:

Description: A fixed price contract sets a single, predetermined price for the entire project, agreed upon before work begins. The contractor is responsible for delivering the house within this budget, regardless of actual costs incurred.

Advantages:

Cost Certainty for Peter: Peter knows the exact cost upfront, aiding financial planning and budgeting.

Example: If the fixed price is £200k, Peter can plan his finances without worrying about cost overruns.

Motivates Efficiency: The contractor is incentivized to control costs and complete the project efficiently to maximize profit.

Example: The contractor might optimize material use to stay within the £200k budget.

Disadvantages:

Risk of Low Quality: To stay within budget, the contractor might cut corners, compromising the house’s quality.

Example: Using cheaper materials to save costs could lead to structural issues.

Inflexibility for Changes: Any changes to the house design (e.g., adding a room) may lead to costly variations or disputes.

Example: Peter’s request for an extra bathroom might significantly increase the price beyond the original £200k.

Cost-Reimbursable (Cost-Plus) Contract:

Description: The contractor is reimbursed for all allowable costs incurred during construction (e.g., labor, materials), plus an additional fee (either a fixed amount or a percentage of costs) as profit.

Advantages:

Flexibility for Changes: Peter can make design changes without major disputes, as costs are adjusted accordingly.

Example: Adding a new feature like a skylight can be accommodated with cost adjustments.

Encourages Quality: The contractor has less pressure to cut corners since costs are covered, potentially leading to a higher-quality house.

Example: The contractor might use premium materials, knowing expenses will be reimbursed.

Disadvantages:

Cost Uncertainty for Peter: Total costs are unknown until the project ends, posing a financial risk to Peter.

Example: Costs might escalate from an estimated £180k to £250k due to unexpected expenses.

Less Incentive for Efficiency: The contractor may lack motivation to control costs, as they are reimbursed regardless, potentially inflating expenses.

Example: The contractor might overstaff the project, increasing labor costs unnecessarily.

Time and Materials (T&M) Contract:

Description: The contractor is paid based on the time spent (e.g., hourly labor rates) and materials used, often with a cap or “not-to-exceed” clause to limit total costs. This mechanism is common for projects with uncertain scopes.

Advantages:

Flexibility for Scope Changes: Suitable for construction projects where the final design may evolve, allowing Peter to adjust plans mid-project.

Example: If Peter decides to change the layout midway, the contractor can adapt without major renegotiation.

Transparency in Costs: Peter can see detailed breakdowns of labor and material expenses, ensuring clarity in spending.

Example: Peter receives itemized bills showing £5k for materials and £3k for labor each month.

Disadvantages:

Cost Overrun Risk: Without a strict cap, costs can spiral if the project takes longer or requires more materials than expected.

Example: A delay due to weather might increase labor costs beyond the budget.

Requires Close Monitoring: Peter must actively oversee the project to prevent inefficiencies or overbilling by the contractor.

Example: The contractor might overstate hours worked, requiring Peter to verify timesheets.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide dedicates significant attention to pricing mechanisms in contracts, particularly in the context of financial management and risk allocation. It identifies pricing structures like fixed price, cost-reimbursable, and time and materials as key methods to balance cost control, flexibility, and quality in contracts, such as Peter’s construction project. The guide emphasizes that the choice of pricing mechanism impacts "financial risk, cost certainty, and contractor behavior," aligning with L5M4’s focus on achieving value for money.

Detailed Explanation of Each Pricing Mechanism:

Fixed Price (Lump Sum) Contract:

The guide describes fixed price contracts as providing "cost certainty for the buyer" but warns of risks like "quality compromise" if contractors face cost pressures. For Peter, this mechanism ensures he knows the exact cost (£200k), but he must specify detailed requirements upfront to avoid disputes over changes.

Financial Link: L5M4 highlights that fixed pricing supports budget adherence but requires robust risk management (e.g., quality inspections) to prevent cost savings at the expense of quality.

Cost-Reimbursable (Cost-Plus) Contract:

The guide notes that cost-plus contracts offer "flexibility for uncertain scopes" but shift cost risk to the buyer. For Peter, this means he can adjust the house design, but he must monitor costs closely to avoid overruns.

Practical Consideration: The guide advises setting a maximum cost ceiling or defining allowable costs to mitigate the risk of escalation, ensuring financial control.

Time and Materials (T&M) Contract:

L5M4 identifies T&M contracts as suitable for "projects with undefined scopes," offering transparency but requiring "active oversight." For Peter, thismechanism suits a construction project with potential design changes, but he needs to manage the contractor to prevent inefficiencies.

Risk Management: The guide recommends including a not-to-exceed clause to cap costs, aligning with financial management principles of cost control.

Application to Peter’s Scenario:

Fixed Price: Best if Peter has a clear, unchanging design for the house, ensuring cost certainty but requiring strict quality checks.

Cost-Reimbursable: Ideal if Peter anticipates design changes (e.g., adding features), but he must set cost limits to manage financial risk.

Time and Materials: Suitable if the project scope is uncertain, offering flexibility but demanding Peter’s involvement to monitor costs and progress.

Peter should choose based on his priorities: cost certainty (Fixed Price), flexibility (Cost-Reimbursable), or transparency (T&M).

Broader Implications:

The guide stresses aligning the pricing mechanism with project complexity and risk tolerance. For construction, where scope changes are common, a hybrid approach (e.g., fixed price with allowances for variations) might balance cost and flexibility.

Financially, the choice impacts Peter’s budget and risk exposure. Fixed price minimizes financial risk but may compromise quality, while cost-plus and T&M require careful oversight to ensure value for money, a core L5M4 principle.

Rachel is looking to put together a contract for the supply of raw materials to her manufacturing organisation and is considering a short contract (12 months) vs a long contract (5 years). What are the advantages and disadvantages of these options? (25 marks)

See the answer in Explanation below:

Rachel’s decision between a short-term (12 months) and long-term (5 years) contract for raw material supply will impact her manufacturing organization’s financial stability, operational flexibility, and supplier relationships. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, contract duration affects cost control, risk management, and value delivery. Below are the advantages and disadvantages of each option, explained in detail:

Short-Term Contract (12 Months):

Advantages:

Flexibility to Adapt:

Allows Rachel to reassess supplier performance, market conditions, or material requirements annually and switch suppliers if needed.

Example: If a new supplier offers better prices after 12 months, Rachel can renegotiate or switch.

Reduced Long-Term Risk:

Limits exposure to supplier failure or market volatility (e.g., price hikes) over an extended period.

Example: If the supplier goes bankrupt, Rachel is committed for only 12 months, minimizing disruption.

Opportunity to Test Suppliers:

Provides a trial period to evaluate the supplier’s reliability and quality before committing long-term.

Example: Rachel can assess if the supplier meets 98% on-time delivery before extending the contract.

Disadvantages:

Potential for Higher Costs:

Suppliers may charge a premium for short-term contracts due to uncertainty, or Rachel may miss bulk discounts.

Example: A 12-month contract might cost 10% more per unit than a 5-year deal.

Frequent Renegotiation Effort:

Requires annual contract renewals or sourcing processes, increasing administrative time and costs.

Example: Rachel’s team must spend time each year re-tendering or negotiating terms.

Supply Chain Instability:

Short-term contracts may lead to inconsistent supply if the supplier prioritizes long-term clients or if market shortages occur.

Example: During a material shortage, the supplier might prioritize a 5-year contract client over Rachel.

Long-Term Contract (5 Years):

Advantages:

Cost Stability and Savings:

Locks in prices, protecting against market volatility, and often secures discounts for long-term commitment.

Example: A 5-year contract might fix the price at £10 per unit, saving 15% compared to annual fluctuations.

Stronger Supplier Relationship:

Fosters collaboration and trust, encouraging the supplier to prioritize Rachel’s needs and invest in her requirements.

Example: The supplier might dedicate production capacity to ensure Rachel’s supply.

Reduced Administrative Burden:

Eliminates the need for frequent renegotiations, saving time and resources over the contract period.

Example: Rachel’s team can focus on other priorities instead of annual sourcing.

Disadvantages:

Inflexibility:

Commits Rachel to one supplier, limiting her ability to switch if performance declines or better options emerge.

Example: If a new supplier offers better quality after 2 years, Rachel is still locked in for 3 more years.

Higher Risk Exposure:

Increases vulnerability to supplier failure, market changes, or quality issues over a longer period.

Example: If the supplier’s quality drops in Year 3, Rachel is stuck until Year 5.

Opportunity Cost:

Locks Rachel into a deal that might become uncompetitive if market prices drop or new technologies emerge.

Example: If raw material prices fall by 20% in Year 2, Rachel cannot renegotiate to benefit.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide discusses contract duration as a key decision in procurement, impacting "cost management, risk allocation, and supplier relationships." It highlights that short-term and long-term contracts each offer distinct benefits and challenges, requiring buyers like Rachel to balance flexibility, cost, and stability based on their organization’s needs.

Short-Term Contract (12 Months):

Advantages: The guide notes that short-term contracts provide "flexibility to respond to market changes," aligning with L5M4’s risk management focus. They also allow for "supplier performance evaluation" before long-term commitment, reducing the risk of locking into a poor supplier.

Disadvantages: L5M4 warns that short-term contracts may lead to "higher costs" due to lack of economies of scale and "increased administrative effort" from frequent sourcing, impacting financial efficiency. Supply chain instability is also a concern, as suppliers may not prioritize short-term clients.

Long-Term Contract (5 Years):

Advantages: The guide emphasizes that long-term contracts deliver "price stability" and "cost savings" by securing favorable rates, a key financial management goal. They also "build strategic partnerships," fostering collaboration, as seen in supplier development (Question 3).

Disadvantages: L5M4 highlights the "risk of inflexibility" and "exposure to supplier failure" in long-term contracts, as buyers are committed even if conditions change. The guide also notes the "opportunity cost" of missing out on market improvements, such as price drops or new suppliers.

Application to Rachel’s Scenario:

Short-Term: Suitable if Rachel’s market is volatile (e.g., fluctuating raw material prices) or if she’s unsure about the supplier’s reliability. However, she risks higher costs and supply disruptions.

Long-Term: Ideal if Rachel values cost certainty and a stable supply for her manufacturing operations, but she must ensure the supplier is reliable and include clauses (e.g., price reviews) to mitigate inflexibility.

Financially, a long-term contract might save costs but requires risk management (e.g., exit clauses), while a short-term contract offers flexibility but may increase procurement expenses.

What is a ‘Balanced Scorecard’? (15 marks). What would be the benefits of using one? (10 marks)

See the answer in Explanation below:

Part 1: What is a ‘Balanced Scorecard’? (15 marks)

A Balanced Scorecard (BSC) is a strategic performance management tool that provides a framework for measuring and monitoring an organization’s performance across multiple perspectives beyond just financial metrics. Introduced by Robert Kaplan and David Norton, it integrates financial and non-financial indicators to give a holistic view of organizational success. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, the BSC is relevant for evaluating contract performance and supplier relationships by aligning them with broader business objectives. Below is a step-by-step explanation:

Definition:

The BSC is a structured approach that tracks performance across four key perspectives: Financial, Customer, Internal Processes, and Learning & Growth.

It translates strategic goals into measurable objectives and KPIs.

Four Perspectives:

Financial Perspective: Focuses on financial outcomes (e.g., cost savings, profitability).

Customer Perspective: Measures customer satisfaction and service quality (e.g., delivery reliability).

Internal Process Perspective: Evaluates operational efficiency (e.g., process cycle time).

Learning & Growth Perspective: Assesses organizational capability and innovation (e.g., staff training levels).

Application in Contracts:

In contract management, the BSC links supplier performance to strategic goals, ensuring alignment with financial and operational targets.

Example: A supplier’s on-time delivery (Customer) impacts cost efficiency (Financial) and requires process optimization (Internal Processes).

Part 2: What would be the benefits of using one? (10 marks)

The Balanced Scorecard offers several advantages, particularly in managing contracts and supplier performance. Below are the key benefits:

Holistic Performance View:

Combines financial and non-financial metrics for a comprehensive assessment.

Example: Tracks cost reductions alongside customer satisfaction improvements.

Improved Decision-Making:

Provides data-driven insights across multiple dimensions, aiding strategic choices.

Example: Identifies if poor supplier training (Learning & Growth) causes delays (Internal Processes).

Alignment with Strategy:

Ensures contract activities support broader organizational goals.

Example: Links supplier innovation to long-term competitiveness.

Enhanced Communication:

Offers a clear framework to share performance expectations with suppliers and stakeholders.

Example: A BSC report highlights areas needing improvement, fostering collaboration.

Exact Extract Explanation:

Part 1: What is a ‘Balanced Scorecard’?

The CIPS L5M4 Advanced Contract and Financial Management study guide does not explicitly define the Balanced Scorecard in a dedicated section but references it within the context of performance measurement tools in contract and supplier management. It aligns with the guide’s emphasis on "measuring performance beyond financial outcomes" to ensure value for money andstrategic success. The BSC is presented as a method to "balance short-term financial goals with long-term capability development," making it highly relevant to contract management.

Detailed Explanation:

The guide explains that traditional financial metrics alone (e.g., budget adherence) are insufficient for assessing contract success. The BSC addresses this by incorporating the four perspectives:

Financial: Ensures contracts deliver cost efficiencies or ROI, a core L5M4 focus. Example KPI: "Cost per unit reduced by 5%."

Customer: Links supplier performance to end-user satisfaction, such as "95% on-time delivery."

Internal Processes: Monitors operational effectiveness, like "reduced procurement cycle time by 10%."

Learning & Growth: Focuses on capability building, such as "supplier staff trained in new technology."

In practice, a BSC for a supplier might include KPIs like profit margin (Financial), complaint resolution time (Customer), defect rate (Internal Processes), and innovation proposals (Learning & Growth).

The guide stresses that the BSC is customizable, allowing organizations to tailor it to specific contract goals, such as sustainability or quality improvement.

Part 2: Benefits of Using a Balanced Scorecard

The study guide highlights the BSC’s value in providing "a structured approach to performance management" that supports financial and strategic objectives. Its benefits are implicitly tied to L5M4’s focus on achieving value for money and managing supplier relationships effectively.

Holistic Performance View:

The guide notes that relying solely on financial data can overlook critical issues like quality or supplier capability. The BSC’s multi-perspective approach ensures a rounded evaluation, e.g., identifying if cost savings compromise service levels.

Improved Decision-Making:

By presenting performance data across all four areas, the BSC helps managers prioritize actions. The guide suggests that "performance tools should inform corrective measures," and the BSC excels here by linking cause (e.g., poor training) to effect (e.g., delays).

Alignment with Strategy:

Chapter 2 emphasizes aligning supplier performance with organizational goals. The BSC achieves this by translating high-level objectives (e.g., "improve market share") into actionable supplier metrics (e.g., "faster product development").

Enhanced Communication:

The guide advocates clear performance reporting to stakeholders. The BSC’s visual framework (e.g., a dashboard) simplifies discussions with suppliers, ensuring mutual understanding of expectations and progress.

Practical Example:

A company using a BSC might evaluate a supplier contract with:

Financial: 10% cost reduction achieved.

Customer: 98% customer satisfaction score.

Internal Processes: 2-day order processing time.

Learning & Growth: 80% of supplier staff certified in quality standards.

This holistic view ensures the contract delivers both immediate financial benefits and sustainable value, a key L5M4 principle.

With reference to the SCOR Model, how can an organization integrate operational processes throughout the supply chain? What are the benefits of doing this? (25 points)

See the answer in Explanation below:

Part 1: How to Integrate Operational Processes Using the SCOR ModelThe Supply Chain Operations Reference (SCOR) Model provides a framework to integrate supply chain processes. Below is a step-by-step explanation:

Step 1: Understand SCOR ComponentsSCOR includes five core processes: Plan, Source, Make, Deliver, and Return, spanning the entire supply chain from suppliers to customers.

Step 2: Integration Approach

Plan:Align demand forecasting and resource planning across all supply chain partners.

Source:Standardize procurement processes with suppliers for consistent material flow.

Make:Coordinate production schedules with demand plans and supplier inputs.

Deliver:Streamline logistics and distribution to ensure timely customer delivery.

Return:Integrate reverse logistics for returns or recycling across the chain.

Step 3: ImplementationUse SCOR metrics (e.g., delivery reliability, cost-to-serve) and best practices to align processes, supported by technology like ERP systems.

Outcome:Creates a cohesive, end-to-end supply chain operation.

Part 2: Benefits of Integration

Step 1: Improved EfficiencyReduces redundancies and delays by synchronizing processes (e.g., faster order fulfillment).

Step 2: Enhanced VisibilityProvides real-time data across the chain, aiding decision-making.

Step 3: Better Customer ServiceEnsures consistent delivery and quality, boosting satisfaction.

Outcome:Drives operational excellence and competitiveness.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details the SCOR Model:

Integration:"SCOR integrates supply chain processes—Plan, Source, Make, Deliver, Return—ensuring alignment from suppliers to end customers" (CIPS L5M4 Study Guide, Chapter 2, Section 2.2). It emphasizes standardized workflows and metrics.

Benefits:"Benefits include increased efficiency, visibility, and customer satisfaction through streamlined operations" (CIPS L5M4 Study Guide, Chapter 2, Section 2.2).This supports strategic supply chain management in procurement. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.===========

A manufacturing organization is looking into the option of benchmarking. Describe how a benchmarking exercise can be conducted and common reasons for benchmarking failure that the organization should be aware of (25 points)

See the answer in Explanation below:

Part 1: How a Benchmarking Exercise Can Be ConductedA benchmarking exercise follows a structured process to ensure meaningful outcomes:

Step 1: Define ObjectivesIdentify goals (e.g., reduce production costs, improve lead times) and select metrics (e.g., cost per unit).

Step 2: Choose Benchmarking TypeDecide on internal (e.g., between plants), competitive (e.g., rival firm), or best-in-class (e.g., industry leader).

Step 3: Collect DataGather internal performance data and external benchmarks via research, surveys, or industry reports.

Step 4: Analyze GapsCompare data to identify disparities (e.g., higher costs than peers) and root causes.

Step 5: Implement ImprovementsDevelop and execute an action plan based on findings (e.g., adopt new technology).

Step 6: Monitor ResultsTrack progress and adjust strategies to sustain gains.

Outcome:Systematically improves manufacturing performance.

Part 2: Common Reasons for Benchmarking Failure

Step 1: Lack of Clear ObjectivesVague goals (e.g., “improve efficiency”) lead to unfocused efforts and poor results.

Step 2: Poor Data QualityInaccurate or incomplete data (e.g., outdated competitor stats) skews comparisons.

Step 3: Resistance to ChangeStaff or management reluctance to adopt new practices stalls implementation.

Outcome:Undermines the exercise’s effectiveness.

Exact Extract Explanation:

The CIPS L5M4 Study Guide outlines benchmarking processes and pitfalls:

Process:"Benchmarking involves setting objectives, selecting comparators, collecting and analyzing data, implementing changes, and monitoring outcomes" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).

Failures:"Common failures include unclear objectives, unreliable data, and organizational resistance" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).This is critical for manufacturing firms optimizing supply chains. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.

Discuss the different financial objectives of the following organization types: public sector, private sector, charity sector (25 points)

See the answer in Explanation below:

The financial objectives of organizations vary significantly depending on their type—public sector, private sector, or charity sector. Below is a detailed step-by-step explanation of the financial objectives for each:

Public Sector Organizations

Step 1: Understand the PurposePublic sector organizations are government-owned or controlled entities focused on delivering public services rather than generating profit.

Step 2: Identify Financial Objectives

Value for Money (VfM):Ensuring efficient use of taxpayer funds by balancing economy, efficiency, and effectiveness.

Budget Compliance:Operating within allocated budgets set by government policies.

Service Delivery:Prioritizing funds to meet public needs (e.g., healthcare, education) rather than profit.

Cost Control:Minimizing waste and ensuring transparency in financial management.

Private Sector Organizations

Step 1: Understand the PurposePrivate sector organizations are privately owned businesses aiming to generate profit for owners or shareholders.

Step 2: Identify Financial Objectives

Profit Maximization:Achieving the highest possible financial returns.

Shareholder Value:Increasing share prices or dividends for investors.

Revenue Growth:Expanding sales and market share to boost income.

Cost Efficiency:Reducing operational costs to improve profit margins.

Charity Sector Organizations

Step 1: Understand the PurposeCharities are non-profit entities focused on social, environmental, or humanitarian goals rather than profit.

Step 2: Identify Financial Objectives

Fundraising Efficiency:Maximizing income from donations, grants, or events.

Cost Management:Keeping administrative costs low to direct funds to the cause.

Sustainability:Ensuring long-term financial stability to continue operations.

Transparency:Demonstrating accountability to donors and stakeholders.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes understanding organizational objectives as a foundation for effective financial and contract management. According to the guide:

Public Sector:The focus is on "delivering value for money and achieving social outcomes rather than profit" (CIPS L5M4 Study Guide, Chapter 1, Section 1.2). This includesadhering to strict budgetary controls and public accountability standards.

Private Sector:The guide highlights that "private sector organizations prioritize profit maximization and shareholder wealth" (CIPS L5M4 Study Guide, Chapter 1, Section 1.3). Financial strategies are aligned with competitive market performance and cost efficiencies.

Charity Sector:Charities aim to "maximize the impact of funds raised while maintaining financial sustainability" (CIPS L5M4 Study Guide, Chapter 1, Section 1.4). This involves balancing fundraising efforts with low overheads and compliance with regulatory requirements.These distinctions are critical for procurement professionals to align contract strategies with organizational goals. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.

Copyright © 2021-2025 CertsTopics. All Rights Reserved