Verified By IT Certified Experts

CertsTopics.com Certified Safe Files

Up-To-Date Exam Study Material

99.5% High Success Pass Rate

100% Accurate Answers

Instant Downloads

Exam Questions And Answers PDF

Try Demo Before You Buy

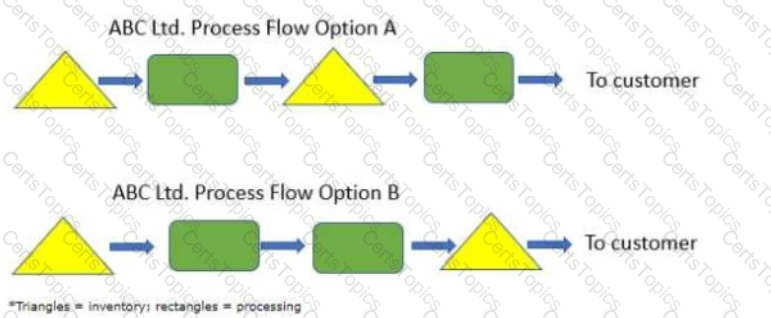

A firm has created the following process flow diagrams depicting two possible strategies for the production of a new product line. The triangles represent inventory, and the rectangles represent processing. Each of the two options start with the same raw materials, and both create the product through two stages of processing.

Which of the following statements is correct?

If a shipment has a gross weight of 500 pounds and overall dimensions of 42 inches x 48 inches x 48 inches, what is the density of the shipment (in pounds per cubic foot)?

Which of the following is MOST likely to be an advantage of a standardization program?